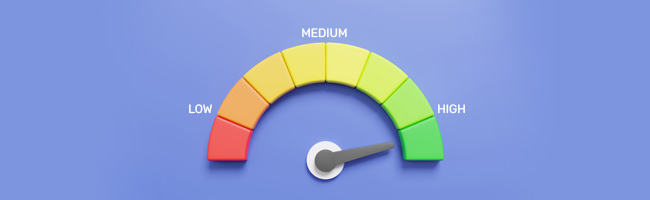

A credit score or CIBIL score is one of the essential parameters through which banks and lending institutions assess a prospective borrower’s financial health. Lenders use this information to assess how effectively applicants can manage their credit, which influences their decisions on granting loan approvals. A higher score can make it easier to get sanctions for new loans and other types of credit at competitive rates of interest as compared to a low credit score. In this article, we delve into understanding the credit score range and what it means to the lenders and how one can improve a low credit score.

What is a Credit Score?

A credit score or CIBIL score is the summary of your credit history in the form of a three-digit figure ranging from 300 to 900. It is generated by credit bureaus like TransUnion CIBIL, Experian, Equifax and CRIF High Mark by assessing your credit reports.

A credit score of 750 considered ideal. Individuals with such a credit score can have a better chance of borrowing higher loan amounts with the best possible rates and terms. Contrarily, a lower score may fetch you loans of a smaller principal amount and higher interest rates.

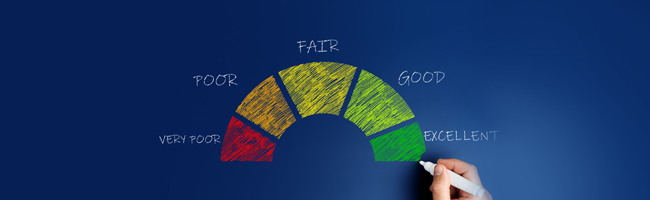

The following table displays the CIBIL score range:

| Your CIBIL Score | How it translates to the lender |

|---|---|

| 800-900 | An excellent score range that Indicates that you have never defaulted on your EMI and credit bill payments. |

| 750-800 | A very good CIBIL score with which you can negotiate and bargain on your interest rate. |

| 625-750 | You have a decent credit history with very few irregularities. You may get a loan but at a higher interest rate. |

| 300-625 | This score indicates high frequencies of defaults and irregularities. You may find it very difficult to get a loan unless you improve your CIBIL score. |

Note: The CIBIL Score Range is defined as per the industry standards.

Also Read: What is CIBIL Score and How It Works

Importance of a Credit Score for a Credit Card

Just like any other form of credit, when you apply for a credit card, lenders will look up your credit score to examine your creditworthiness and ability to repay debts on time before approving your application. Credit cards can also be used effectively to improve your credit score.

How Credit Cards Affect Your Credit Score

Credit cards can enhance your monetary well-being by boosting a failing CIBIL score. Banks and financial institutions primarily rely on CIBIL scores to determine eligibility for issuing loans or credit cards to customers. Whether you have a low or nil credit history, using a credit card wisely can elevate your credit rating.

Also Read: Boost Your Credit Score by Minding the Factors that Affect It

7 Tips to Increase Your Credit Score with a Credit Card

There are several ways to use credit cards to improve your credit score. If you already own one or even a few of them, bear in mind the following considerations:

1. Make Credit Purchases Smartly

Most people prefer using credit cards to make expensive purchases intending to pay them off later. At times, this can have negative consequences if repayments are not made on time thereby affecting the CIBIL score. Therefore, it’s best to budget smartly and initiate cash transactions whenever possible to avoid exhausting the credit limit. This way you can keep your card usage to a minimum and achieve a favourable credit history with realistic money management.

2. Pay Bills with a Credit Card

You can regularly pay internet bills, phone bills, and utility bills like water and electricity with a credit card to create a positive credit history and bolster your CIBIL score. Since these expenses are much lower when compared to buying material goods, the resultant credit card dues can be comfortably paid off.

3. Make Regular Repayments

Even if you cannot clear the entire amount outstanding on a credit card, try to pay the minimum amount due on or before the due date. Paying off credit card debts, as much as possible, can increase your CIBIL score quickly qualifying you as a low credit risk.

4. Set Repayment Reminders for Your Credit Card

A regular repayment schedule can work wonders for your credit rating. Credit card users should always pay their credit dues on time. Delays in payments or pending dues may attract penalties that can cause a dip in your CIBIL score. Hence, set reminders for EMI payments so that you don’t miss out on any instalments.

5. Maintain Older Credit Cards

Past credit history that spans a longer period of time can strengthen your credit profile. So, retain old credit cards to build a sound credit history and raise your credit score, and pay your credit bills in full and on time.

6. Increase Your Credit Limit

Your credit utilisation ratio plays a significant part in supporting a good credit score. Restricting credit usage based on your allotted limit can increase your score. But once you overstep the limit, it has the opposite effect of reducing your credit score. This can be managed best by requesting your lender to customise the credit limit according to your expenses.

7. Check Your CIBIL Report for Errors

Sometimes, there could be mistakes, incorrect information, or a delay in updating details in your credit records, which may potentially bring down your credit score. Hence, check your CIBIL score periodically to identify possible errors and rectify them by submitting a CIBIL Dispute Resolution form online.

It is vital to maintain a good credit score even after you secure a loan. But if your credit score is already on the lower side, you can follow these practical tips to improve your CIBIL score.

Also Read: Important Things Might Go Wrong with Your CIBIL Report

The Dos and Don'ts of Credit Card Usage

Here are certain do’s and don’ts that you should be aware of in order to make the most of your credit card:

Do’s of Credit Card Usage

Pay Your Balance in Full: Always try to pay off your credit card balance in full each month to avoid accruing interest charges.

Set up Payment Reminders: Ensure timely payments by setting up reminders or automating payments to avoid late fees and potential credit score impacts.

Monitor Your Statements: Regularly review your credit card statements for unauthorised transactions or errors, promptly reporting any discrepancies to your card issuer.

Keep Credit Utilisation Low: Aim to use only 30% of your total credit limit to maintain a healthy credit score and demonstrate responsible borrowing behaviour.

Don’ts of Credit Card Usage

Don’t Miss Any of Your Payments: Avoid missing credit card payments as it can lead to late fees, penalty interest rates, and negatively impact your credit score.

Don't Overuse Your Credit: Avoid exhausting your credit limit. Keeping your credit utilisation ratio below 30% helps maintain a good credit score and shows responsible financial management.

Don’t Apply for Credit Cards if Not Required: Avoid applying for multiple credit cards if not required. It's important to assess your financial needs carefully and consider the implications of each card before applying, ensuring they align with your financial goals and ability to manage responsibly.

Summing Up

A credit score is important for loan approvals and interest rates. Scores range from 300 to 900, with higher scores indicating better creditworthiness. Managing credit cards wisely, like paying bills on time, and maintaining low balances can improve scores. Regularly monitoring and correcting errors in your credit report also helps maintain a healthy score.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Content with tag .

Trending Articles

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

cibil Cibil

[N][T][T][N][T]

How Does Being A Loan Guarantor Affect Your Credit Score?2023-03-23 | 4 min

cibil Cibil

[N][T][T][N][T]

What is Credit Mix and How to Boost Your Credit Score?2023-03-27 | 7 min

cibil Cibil

[N][T][T][N][T]

Will a Loan Settlement Ruin My CIBIL Score?2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Does CIBIL Score Affect Loan Against Property Eligibility?2023-02-15 | 7 min

cibil Cibil

[N][T][T][N][T]

How To Improve CIBIL Score After A Payment Default?2023-03-29 | 4 min

cibil Cibil

[N][T][T][N][T]

What Is a Good Credit Score for a Home Loan?2022-12-28 | 5 min

cibil Cibil

[N][T][T][N][T]

Things That Can Go Wrong with Your CIBIL Report2023-03-15 | 5 min

cibil Cibil

[N][T][T][N][T]

How a Good CIBIL Score Can Help You Celebrate the Festive Season Better2024-03-19 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can Your CIBIL Score Help in Negotiating Better Home Loan Deals2023-05-18 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What You Can Do to Improve Your CIBIL Score2023-03-16 | 4 min

cibil Cibil

[N][T][T][N][T]

Top 10 Reasons For Low CIBIL Score & How To Improve It2024-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Five Reasons Why a Bad Credit Score Could Lead to Loan Rejection2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

cibil Cibil

[N][T][T][N][T]

Ways You Can Improve your Credit Score for a Small Business2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

How Does Missing One Payment Affect Your CIBIL Score?2024-05-15 | 4 min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

cibil Cibil

[N][T][T][N][T]

Easy Ways to Maintain a Good Business Credit Score2024-01-10 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s How a Short-term Loan Can Help You Improve Your CIBIL Score2024-03-25 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can I Raise My Credit Score From 360 to 800 Within a Year?2024-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Know How Mortgage Loan Affect Your CIBIL Score2024-02-05 | 5 Min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

cibil Cibil

[N][T][T][N][T]

What Are Tradelines and How to Find Them On Your Credit Report?2024-05-28 | 4 min

cibil Cibil

[N][T][T][N][T]

Introduction to Credit Information Bureau India Limited (CIBIL)2024-04-15 | 6 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How Many Credit Inquiries are Too Much in a Year2023-09-21 | 2 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

A Helpful Guide to Understanding Your Credit Report2024-01-26 | 5 min

cibil Cibil

[N][T][T][N][T]

Difference Between Credit Score and CIBIL Score2024-02-15 | 5 min

cibil Cibil

[N][T][T][N][T]

Loan Settlement And Its Effects On Your Credit Score2024-03-07 | 6 min

cibil Cibil

[N][T][T][N][T]

Everything You Need to Know About the Ideal CIBIL Score for Business Loan2024-01-17 | 4 min

cibil Cibil

[N][T][T][N][T]

What is the Role of CIBIL Score in Getting a Home Loan?2024-05-08 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact Of a Co-Applicant’s CIBIL Score On Your Home Loan Application2023-01-20 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Increase Your CIBIL Score Above 800: 6 Proven Methods2024-01-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How is CIBIL Score Calculated - Factors That Affect CIBIL Score Calculations2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2023-03-23 | 5 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Report Errors and How to Fix Them_WC2023-07-11 | 4 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

cibil Cibil

[N][T][T][N][T]

What to Know About CIBIL Score 2.02023-08-23 | 3 min

cibil Cibil

[N][T][T][N][T]

CIBIL Score Charges & Services You Must Know2023-04-04 | 2 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Mix and How Can It Help Your Credit Score?2023-07-12 | 3 min

cibil Cibil

[N][T][T][N][T]

How to Get a Good Credit Mix and Boost Your Credit Score2023-07-11 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is CIBIL Score Important for Your Financial Health?2023-04-17 | 3 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL Score and How is it Impacted by a Missed EMI?2023-05-31 | 2 min

cibil Cibil

[N][T][T][N][T]

The Role of CIBIL Score in Determining your Home Loan Disbursement Amount2023-05-31 | 2 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Tips to Maintain Your Business CIBIL Score Above 7002023-02-02 | 5 min

cibil Cibil

[N][T][T][N][T]

Is a Good CIBIL Score Mandatory for Home Loan Approval?2023-02-17 | 4 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score & Tips To Improve It2023-02-21 | 5 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Scoring Models You Must Know2023-03-16 | 5 min

cibil Cibil

[N][T][T][N][T]

How Do You Establish a Credit Score for the First Time?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

Ways to Maintain a Healthy Credit Score and Profile2023-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

Top Tips to Improve Credit Score Immediately to Get Your Loan Approved2023-03-30 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons to Maintain a Positive Credit Profile and a High CIBIL Score2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Does Applying for Credit Affects One's CIBIL Score?2023-03-15 | 3 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score for Achieving Business Goals2023-03-16 | 5 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Reveal About You?2023-04-05 | 5 min

cibil Cibil

[N][T][T][N][T]

7 Tips to Help You Improve Your CIBIL Score2022-12-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Boost Your Credit Score By Minding The Factors That Affect It2023-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

10 Effective Strategies for Boosting Your Credit Rating2023-03-24 | 6 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

cibil Cibil

[N][T][T][N][T]

Why is Credit Score Important After Retirement?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

5 Ways to Increase CIBIL Score After Job Loss2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

7 Easy Tips On How Chartered Accountants Can Increase Their CIBIL Score?2023-01-23 | 4 min

cibil Cibil

[N][T][T][N][T]

High CIBIL Score Helps Low-Interest Rate Loans2023-09-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Some of the Common Credit Mistakes to Avoid2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

How Long Does It Take to Improve a CIBIL Score2023-03-29 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can Customers Check Their Credit History?