In India, four credit information agencies or credit rating agencies have been authorized by the Reserve Bank of India to collect information on borrowers’ attitudes towards credit. These are Experian, Equifax, CRIF Highmark and TransUnion CIBIL. The credit rating given by TransUnion CIBIL is known as the CIBIL score and most lenders rely on TransUnion CIBIL to help them verify whether a borrower is creditworthy.

How is CIBIL Score Calculated?

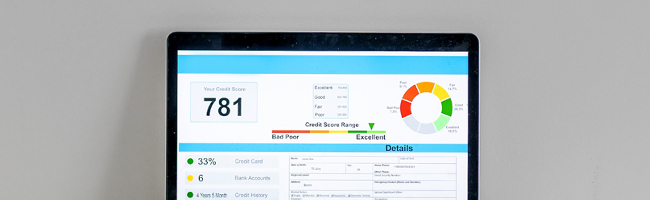

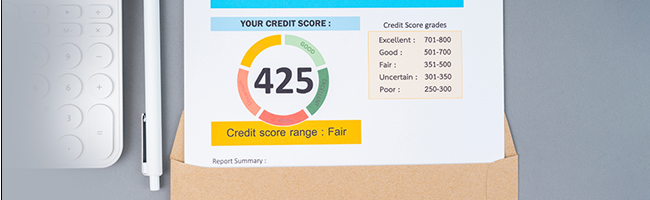

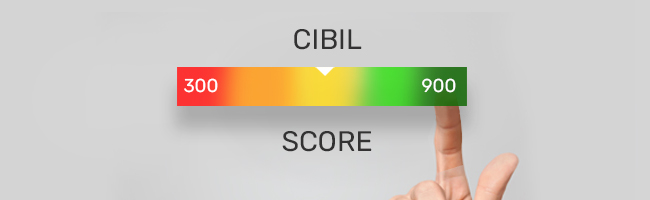

The credit score or CIBIL score is a numerical representation of one’s creditworthiness and repayment capacity. It is a three-digit number ranging between 300 and 900 that tells a lender the risk involved for them in lending money to the borrower. How is credit score calculated? Credit rating agencies calculate an individual’s CIBIL score based on all the information provided in an individual’s credit report. Before we get to the details of CIBIL score calculations, let us understand the various CIBIL score ranges and the impact they have on a borrower’s ability to borrow credit.

Factors That Affect CIBIL Score Calculations

Four different credit information bureaus in India are authorized by the Reserve Bank of India to assign credit scores to borrowers. Every credit information bureau uses a different CIBIL score calculation formula. However, since an individual’s credit score primarily depends on how they handle credit, the elements that affect a borrower’s credit score stay the same. Let us look at the elements of CIBIL score.

How the Borrower Handles Debt

All credit information agencies assign credit scores to borrowers based on how they have handled debt in the past. A borrower’s credit history, i.e. their track record of whether they have always paid EMIs and cleared credit card bills on time, the number of loans they have taken and successfully repaid, the number of times they have been rejected by lenders, etc., gives credit information agencies an idea about how the borrower handles debt. The component that influences credit score calculations is credit history, which accounts for 35% of a borrower's credit score.

What is the Credit Mix They Are Having?

Loans are of two types: secured and unsecured. Secured loans are those that are backed by collateral. In the case of secured loans, there is zero to no risk involved for the lender in lending money to the borrower. Thus, lenders sanction secured loans at low-interest rates. Home loans and loans against property are examples of secured loans. Unsecured loans, on the other hand, are not backed by any collateral, and therefore, these loans carry a higher risk for the lender. Lenders like those borrowers who have handled a mix of both types of credit, as it assures a lender of the borrower’s ability to handle both secured and unsecured loans.

Also Read: Credit Mix: Different Types of Credit that Boost Your Credit Score

Credit Exposure

Most borrowers understand the concept of credit exposure in the form of credit utilization rate or ratio. The credit utilization ratio is the ratio of credit used by a borrower to the credit available to them. Borrowers must never exhaust their credit limit as lenders see this as irresponsible behaviour towards credit. Maintaining a good CIBIL score requires borrowers to maintain a credit utilization ratio of 30% or less. Borrowers must also make it a point to clear their entire credit card bills and not just pay the minimum due as this too reduces one’s credit rating.

Other Factors

Apart from the factors mentioned above, there are some other factors too that affect CIBIL score calculations. For instance, while calculating CIBIL scores, credit information agencies also look at the hard enquiries under a borrower’s name. Every time a borrower applies for a loan, the lender to whom they have applied approaches a credit rating agency to enquire about the borrower. Enquiries that lenders make are known as hard enquiries. Too many hard enquiries may portray a borrower as being credit-hungry and hamper their credit rating. This is why borrowers should apply for a loan only when absolutely necessary.

Similarly, credit rating agencies also look at what percentage of a borrower’s income is going towards covering the debt. This is known as debt-to-income ratio and for a good CIBIL score, a borrower should keep their debt-to-income ratio under 40%. The length of the credit history is another factor that affects a borrower’s CIBIL score. The longer a borrower’s credit history, the better their CIBIL score.

Final Words

The CIBIL score is a key element that defines your ability to borrow money as well as the terms and conditions on which you will get this money. Building a good CIBIL score takes time. A good CIBIL score is also important as it helps borrowers avail of credit on beneficial terms and conditions, such as a low-interest rate, longer repayment tenor, etc. A bad CIBIL score, on the other hand, makes it difficult for borrowers to get approved for credit. The good thing is that the CIBIL score is not absolute. Borrowers can improve their CIBIL score by practising healthy financial habits.

Also Read: How to Improve your CIBIL Score above 800

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Content with tag .

Trending Articles

cibil Cibil

[N][T][T][N][T]

Loan Rejection Impact on CIBIL Score2024-12-23 | 3 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

cibil Cibil

[N][T][T][N][T]

Does CIBIL Score Affect Loan Against Property Eligibility?2023-02-15 | 7 min

cibil Cibil

[N][T][T][N][T]

Ways You Can Improve your Credit Score for a Small Business2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons to Maintain a Positive Credit Profile and a High CIBIL Score2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score & Tips To Improve It2023-02-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s What You Can Do to Improve Your CIBIL Score2023-03-16 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2024-03-22 | 5 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

What Is Credit Mix and How Can It Help Your Credit Score?2023-07-12 | 3 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

cibil Cibil

[N][T][T][N][T]

What Are Tradelines and How to Find Them On Your Credit Report?2024-05-28 | 4 min

cibil Cibil

[N][T][T][N][T]

5 Ways to Increase CIBIL Score After Job Loss2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

Ways to Improve Your Credit Score with a Credit Card2024-02-02 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

cibil Cibil

[N][T][T][N][T]

Top Tips to Improve Credit Score Immediately to Get Your Loan Approved2023-03-30 | 5 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score for Achieving Business Goals2024-03-13 | 5 min

cibil Cibil

[N][T][T][N][T]

7 Tips to Help You Improve Your CIBIL Score2024-05-15 | 5 min

cibil Cibil

[N][T][T][N][T]

High CIBIL Score Helps Low-Interest Rate Loans2024-06-10 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Increase Your CIBIL Score Above 800: 7 Proven Methods2023-01-24 | 4 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

cibil Cibil

[N][T][T][N][T]

Know How Mortgage Loan Affect Your CIBIL Score2024-02-05 | 5 Min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

cibil Cibil

[N][T][T][N][T]

Five Reasons Why a Bad Credit Score Could Lead to Loan Rejection2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Top 10 Reasons For Low CIBIL Score & How To Improve It2024-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Report Errors and How to Fix Them_WC2023-07-11 | 4 min

cibil Cibil

[N][T][T][N][T]

Will a Loan Settlement Ruin My CIBIL Score?2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

Is a Good CIBIL Score Mandatory for Home Loan Approval?2023-02-17 | 4 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

cibil Cibil

[N][T][T][N][T]

Impact Of a Co-Applicant’s CIBIL Score On Your Home Loan Application2023-01-20 | 4 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

How Do You Establish a Credit Score for the First Time?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

How To Improve CIBIL Score After A Payment Default?2024-03-29 | 4 min

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

cibil Cibil

[N][T][T][N][T]

How Long Does It Take to Improve a CIBIL Score2023-03-29 | 5 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL Score and How is it Impacted by a Missed EMI?2023-05-31 | 2 min

cibil Cibil

[N][T][T][N][T]

Everything You Need to Know About the Ideal CIBIL Score for Business Loan2024-01-17 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Get a Good Credit Mix and Boost Your Credit Score2023-07-11 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s How a Short-term Loan Can Help You Improve Your CIBIL Score2024-03-25 | 5 min

cibil Cibil

[N][T][T][N][T]

How Many Credit Inquiries are Too Much in a Year2023-09-21 | 2 min

cibil Cibil

[N][T][T][N][T]

How a Good CIBIL Score Can Help You Celebrate the Festive Season Better2024-03-19 | 5 min

cibil Cibil

[N][T][T][N][T]

A Helpful Guide to Understanding Your Credit Report2024-01-26 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Being A Loan Guarantor Affect Your Credit Score?2024-03-13 | 4 min

cibil Cibil

[N][T][T][N][T]

How Can Customers Check Their Credit History?2023-06-14 | 3 min

cibil Cibil

[N][T][T][N][T]

How Can Your CIBIL Score Help in Negotiating Better Home Loan Deals2023-05-18 | 4 min

cibil Cibil

[N][T][T][N][T]

What is Credit Mix and How to Boost Your Credit Score?2023-03-27 | 7 min

cibil Cibil

[N][T][T][N][T]

How Does Missing One Payment Affect Your CIBIL Score?2024-05-15 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Introduction to Credit Information Bureau India Limited (CIBIL)2024-04-15 | 6 min

cibil Cibil

[N][T][T][N][T]

Difference Between Credit Score and CIBIL Score2024-02-15 | 5 min

cibil Cibil

[N][T][T][N][T]

Does Applying for Credit Affects One's CIBIL Score?2024-03-14 | 3 min

cibil Cibil

[N][T][T][N][T]

Easy Ways to Maintain a Good Business Credit Score2024-01-10 | 5 min

cibil Cibil

[N][T][T][N][T]

10 Effective Strategies for Boosting Your Credit Rating2023-03-24 | 6 min

cibil Cibil

[N][T][T][N][T]

Boost Your Credit Score By Minding The Factors That Affect It2023-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

cibil Cibil

[N][T][T][N][T]

CIBIL Score Charges & Services You Must Know2023-04-04 | 2 min

cibil Cibil

[N][T][T][N][T]

What to Know About CIBIL Score 2.02024-06-20 | 3 min

cibil Cibil

[N][T][T][N][T]

Some of the Common Credit Mistakes to Avoid2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Increase Your CIBIL Score Above 800: 6 Proven Methods2024-01-24 | 4 min

cibil Cibil

[N][T][T][N][T]

What Is a Good Credit Score for a Home Loan?2022-12-28 | 5 min

cibil Cibil

[N][T][T][N][T]

Things That Can Go Wrong with Your CIBIL Report2023-03-15 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can I Raise My Credit Score From 360 to 800 Within a Year?2024-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Loan Settlement And Its Effects On Your Credit Score2024-03-07 | 6 min

cibil Cibil

[N][T][T][N][T]

What is the Role of CIBIL Score in Getting a Home Loan?2024-05-08 | 5 min

cibil Cibil

[N][T][T][N][T]

Why Is CIBIL Score Important for Your Financial Health?2023-04-17 | 3 min

cibil Cibil

[N][T][T][N][T]

The Role of CIBIL Score in Determining your Home Loan Disbursement Amount2023-05-31 | 2 min

cibil Cibil

[N][T][T][N][T]

Tips to Maintain Your Business CIBIL Score Above 7002023-02-02 | 5 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Scoring Models You Must Know2023-03-16 | 5 min

cibil Cibil

[N][T][T][N][T]

Ways to Maintain a Healthy Credit Score and Profile2023-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Reveal About You?2023-04-05 | 5 min

cibil Cibil

[N][T][T][N][T]

Why is Credit Score Important After Retirement?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

7 Easy Tips On How Chartered Accountants Can Increase Their CIBIL Score?