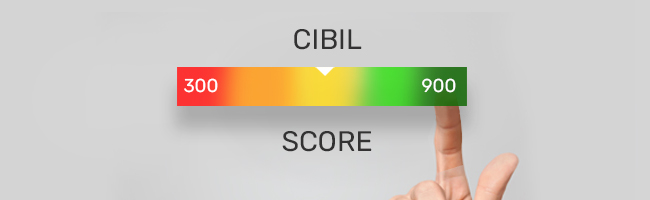

A CIBIL score is a three-digit number representing the creditworthiness of an individual. It ranges from 300 to 900, the closer your score is to 900, the better it is. Financial institutions consider 750 as a decent number and they will conduct through CIBIL checks before sanctioning a Home Loan. Hence, it is recommended to make all the efforts to increase the CIBIL score to enhance your loan eligibility in the future.

6 Easy Tips to Improve Your Credit Score Above 800

A low CIBIL score can lead to rejections when you apply for a credit card or loan. Also, multiple rejections can further decrease your CIBIL score. Improving your CIBIL score might seem challenging but it is an achievable task. Increasing your CIBIL score can increase your chances of securing credit facilities in the future. Therefore, if you are wondering how to improve your CIBIL score above 800, here is the course of action you can take:

1. Monitor Your Credit Report

Regularly monitoring your credit report is essential for maintaining a healthy credit profile. Reviewing your report helps you identify inaccuracies, unauthorised activity, or errors that could negatively impact your credit score. By addressing issues promptly and ensuring accurate information, you can maintain your financial portfolio and take proactive steps to improve your creditworthiness.

Additional Read: How to Check CIBIL Score for Free with PAN Card

2. Opt for a Healthy Mix of Credit

A healthy credit mix of unsecured and secured loans assures the lender of your ability to repay various types of loans easily. Having a combination of a mortgage loan, personal loan, auto loan, and so on, is generally considered a good mix of credit that is sure to keep the CIBIL score in good standing.

3. Keep Track of Your Old Debts

Keep a record of all the successful payments made in the past in your credit report. This will give the lender a positive impression of you as someone who settles dues and they will see you as a reliable, low-risk customer.

4. Use Credit Cards Wisely

If you wish to improve your CIBIL score, you should start using your credit card diligently. You can begin by making low-ticket online purchases using your credit card and repay the amount at the earliest. This will reflect well on your credit history and add to your credit score.

5. Make Timely Payments

One of the key factors that decide your credit health is your debt responsibility. Ensure that you are able to keep up with all your EMI commitments and repay any amount owed on time.

6. Avoid Unnecessary Hard Loan Enquiries

Another thing to bear in mind is that every time a lender conducts a hard loan enquiry, your credit score may be affected. Ensure that you only make loan enquiries when you are sure of your loan eligibility and have conducted your research, so you minimise multiple enquiries at the same time.

Additional Read: Smart Things to Consider Before You Apply for a Home Loan

What is Considered a Good CIBIL Score?

The CIBIL score ranges from 300-900 but the higher the number, the better the chances of getting the loan approved. Most lending institutions consider 750 or higher as the ideal score for quick and smooth loan approvals. If your CIBIL score falls below the desired limit, you still have a chance to raise it to 800. The following table shows the credit score and corresponding rating:

| Credit Score | Rating |

|---|---|

| 800 and above | Excellent |

| 750 – 800 | Very Good |

| 625– 750 | Fair |

| 625 and below | Low |

As a prospective borrower, it is always a good idea to know your CIBIL score and find out how it translates to the lender. For those with a credit score below 625, applying for a loan could be challenging owing to the low score. Nevertheless, one should monitor the report and address the factors that could possibly be affecting the CIBIL score.

What are the Factors Affecting CIBIL Score?

Before moving on to how to improve your CIBIL score, here is a look at the factors that affect the credit score in the first place:

- Credit utilisation ratio

- Outstanding debts, credit card bills, loans

- Number of credit applications

- Accuracy of the credit report

- Credit mix

- Length or duration of credit history

- Closing of previous credit card account(s)

Benefits of Maintaining a Good Credit Score

Having a good credit score can benefit you in numerous ways. Here are a few benefits of maintaining a high credit score:

- Competitive interest rates and better loan terms

- Increased chances of qualifying for a credit or loan

- Higher credit limits

Automated EMI repayments, timely payments on credit card bills, disciplined expenditure, and appropriate financial management help to maintain a positive CIBIL score above 800. It may not be an easy task to monitor but with these 6 proven methods listed above to increase CIBIL score, one can surely achieve a score of 800+. Applicants can check their CIBIL score on CIBIL's official website by paying a nominal fee.

Frequently Asked Questions

You can increase your CIBIL score by:

- Analysing your credit report and clear default or delayed payments.

- Increasing your credit limit

- Opting for a healthy credit mix

- Managing your EMIs effectively so that they are feasible

- Keeping track of previous loans that are successfully repaid

- Using credit cards diligently

- Making timely repayments

- Avoiding hard enquiries

CIBIL Score takes time to improve. You can practice healthy credit habits to increase your credit score. By making timely repayments, avoiding hard inquiries, clearing repayment defaults or delayed payment records from credit report you can increase your credit score.

No, you cannot improve the CIBIL score in 30 days. However, there are some best practices such as opting for a healthy credit mix, keeping track of your old debts, and repaying EMIs consistently can help you improve your CIBIL score.

It is recommended to check your credit score at least once a year to stay informed about your financial health. However, if you are working on improving your credit score, reviewing it every six months is advisable. Regular monitoring helps identify inaccuracies or errors in your credit report, allowing you to address them promptly.

Your credit score is calculated based on several factors including credit utilisation ratio, credit mix, duration of credit, and hard enquiries.

Yes, errors in your credit report can negatively impact your credit score. Mistakes such as incorrect personal information may reduce your creditworthiness.

Improving credit scores from 360 to 800 in a year requires consistent effort and disciplined financial management. Here is how you can achieve this:

- Monitor your credit report: regularly check your credit report for errors and rectify them promptly

- Make timely payments: Pay all credit card bills and loan EMIs on or before the due date

- Reducing outstanding debt: Pay off smaller loans first and avoid accumulating new debt

- Maintain a healthy credit mix: Have a balanced mix of secured loans and unsecured loans

- Avoid hard enquiries: Minimise applications for new credit or loans to avoid multiple hard enquiries

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

[N][T][T][N][T]

Tips to Manage Loan Against Property Repayments Efficiently2024-02-21 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Differences Between Fixed and Floating Interest Rates2024-05-15 | 2 min

home+loan Home Loan

[N][T][T][N][T]

What Do You Need to Know About Home Loan Foreclosure?2023-03-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Monthly Reducing Balance Method for Home Loan Interest2025-02-25 | 3 min

[N][T][T][N][T]

Everything You Need to Know About Home Loan Part-Prepayment2024-12-18 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Age to Buy a House?2025-03-19 | 2 min

tax Tax

[N][T][T][N][T]

Top 5 Tax Benefits and Other Advantages of a Joint Home Loan2024-07-10 | 8 min

home+loan Home Loan

[N][T][T][N][T]

Complete Guide to Securing a Attractive Interest on Home Loans2024-01-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Pick the Best Home Loan Tenure that Suits Your Budget2023-06-29 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Check Housing Loan Eligibility with Home Loan Eligibility Calculator2023-07-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Everything You Need to Know About Top-up Loans on a Home Loan2024-04-09 | 6 min

home+loan Home Loan

[N][T][T][N][T]

A Step-by-Step Guide to Home Loan Balance Transfer Application2024-07-09 | 6 min

cibil Cibil

[N][T][T][N][T]

High CIBIL Score Helps Low-Interest Rate Loans2024-06-10 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Get a Home Loan Without Visiting Branch: A Step-by-Step Guide2024-03-20 | 4 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Balance Transfer: Benefits, Eligibility, and More2024-05-15 | 3 Min

[N][T][T][N][T]

7 Benefits of Taking a Home Loan in India2024-06-19 | 3 min

home+loan Home Loan

[N][T][T][N][T]

An Essential Guide to Refinancing a Home Loan2024-04-22 | 5 Min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Tips to Secure Quick Home Loan Approval2025-03-03 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Residential Property: A Smart Financing Solution2025-03-10 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Agricultural Land: Unlock the Value of Your Property2025-03-07 | 6 min

cibil Cibil

[N][T][T][N][T]

Know How Mortgage Loan Affect Your CIBIL Score2024-02-05 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-04-10 | 6 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loans for Salaried Employees: Eligibility, Documents, and Application Process2025-03-18 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Property Mortgage Loan: A Smart Financing Option for Businesses2025-03-10 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Calculate Your Home Loan Eligibility2025-03-05 | 3 min

[N][T][T][N][T]

Loan Against a Shop- Commercial Property Loans2024-12-18 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Home Loan2023-02-20 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

3 Different Loan Against Property Types You Should Know About2024-02-13 | 5 Min

[N][T][T][N][T]

Home Loan for Pensioners: Eligibility and Benefits2025-03-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

5 Great Ways Women Can Benefit from Taking a Housing Loan2024-01-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Self-Employed Individuals2025-03-03 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Professional Loans Against Property Are Financially Beneficial?2023-03-03 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Reasons Why a Housing Loan Application May Be Rejected2024-02-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

6 Reasons Why Collateral Matters When Applying for a Loan Against Property2023-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

Five Reasons Why a Bad Credit Score Could Lead to Loan Rejection2024-01-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Refinancing: What, Why, and Things to Remember2024-06-17 | 5 Min

cibil Cibil

[N][T][T][N][T]

Top 10 Reasons For Low CIBIL Score & How To Improve It2024-03-01 | 5 min

[N][T][T][N][T]

What is the Purpose of CIBIL Score?2023-03-25 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Joint Home Loan with your Spouse2023-08-04 | 4 min

home+loan Home Loan

[N][T][T][N][T]

What is the Process to Get Your Home Loan Approved Fast with Bajaj Housing Finance?2024-02-15 | 6 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Easy Ways to Pick the Right Loan Against Property Tenor2024-05-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Pay-off Your Debt with Bajaj Housing Finance Loan Against Property2024-02-14 | 5 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Report Errors and How to Fix Them_WC2023-07-11 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Common Mistakes You Must Avoid Making When Applying for a Loan Against Property2023-02-09 | 5 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Making Financial Planning Easy with a Home Loan EMI Calculator2023-09-06 | 2 min

cibil Cibil

[N][T][T][N][T]

Reasons to Maintain a Positive Credit Profile and a High CIBIL Score2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Will a Loan Settlement Ruin My CIBIL Score?2023-03-21 | 4 min

[N][T][T][N][T]

Loan Against Property or A Home Loan: Know What You Need2024-06-11 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Loan Against Property Can be a Good Credit Option for a Startup Business?2023-12-22 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top Benefits of Loan Against Property Over Collateral-free Loans2023-02-23 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Everything You Wanted to Know About Loan Against Property2023-12-16 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Taking a Home Loan to Buy a Property for Investment? Here Are 5 Points to Consider2023-04-17 | 5 min

home+loan Home Loan

[N][T][T][N][T]

4 Key Benefits of Home Loan Balance Transfer to Bajaj Housing Finance Limited2023-01-09 | 5 min

cibil Cibil

[N][T][T][N][T]

Is a Good CIBIL Score Mandatory for Home Loan Approval?2023-02-17 | 4 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

tax Tax

[N][T][T][N][T]

Income Tax Structure in New Regime: New Tax Exemption Limit 20252024-05-08 | 4 min

tax Tax

[N][T][T][N][T]

8 Useful Income Tax Exemptions for Salaried Employees2024-04-18 | 7 min

home+loan Home Loan

[N][T][T][N][T]

What Affects the Interest Rate on Your Home Loan2024-03-13 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Importance of an NOC Letter after Closing Your Home Loan2023-12-14 | 6 min

home+loan Home Loan

[N][T][T][N][T]

The Importance of a Home Loan NOC2023-01-31 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Importance Of a Good Credit Score in The Home Loan Process2023-03-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Consider These Factors Before Foreclosing Your Home Loan2024-04-16 | 3 min

home+loan Home Loan

[N][T][T][N][T]

6 Ways to Reduce Your Home Loan Interest2024-03-20 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Apply for a Mortgage Loan?2025-03-05 | 3 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

[N][T][T][N][T]

What are Tranche Disbursement and Tranche EMI in Home Loans?2025-03-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Down Payment for a Home Loan?2024-05-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Pay Off Your Home Loan Quicker2024-03-11 | 4 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding Loan-to-Value Ratio (LTV) and its Calculation2023-11-28 | 4 Min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

tax Tax

[N][T][T][N][T]

Tax Benefits on Home Loans for Self-Employed Individuals: What You Need to Know2024-06-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Home Loan Settlement: What You Need to Know2025-03-13 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Types of Collateral Properties2024-12-26 | 4 min

[N][T][T][N][T]

Checklist of Documents Required for Home Loan2024-02-07 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact Of a Co-Applicant’s CIBIL Score On Your Home Loan Application2023-01-20 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Gujarat2025-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

All You Should Know About Home Loan Disbursement and Sanctioning Process2024-03-19 | 3 Min

home+loan Home Loan

[N][T][T][N][T]

Difference Between Co-owner, Co-borrower, Co-Applicant, and Co-Signer in Home Loan2023-08-31 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What is an NOC Letter and Why is it Important?2024-05-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Can I Take a Home Loan and a Personal Loan Together?2024-01-17 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Top 5 Home Loan Benefits for First-time Woman Buyers2024-05-14 | 5 min

tax Tax

[N][T][T][N][T]

10 Useful Income Tax Deductions for FY 2022-232024-02-21 | 6 min

home+loan Home Loan

[N][T][T][N][T]

6 Point Differentiation Between Home Loan Vs Home Construction Loan2023-02-15 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

10 Smart Steps for Effective Home Loan Management2024-02-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

MPIGR Madhya Pradesh: A Guide to Property Registration and SAMPADA Services2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

MCGM Property Tax Mumbai: Online Payment, Calculation, and Exemptions Explained2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Domicile Certificate: Meaning, Documents, and How to Apply Online2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Equitable Mortgage vs Registered Mortgage: Key Differences Explained2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Home Loan Processing Time: What to Expect and How to Prepare2025-04-14 | 3 min

[N][T][T][N][T]

Understanding Important Clauses in Your Home Loan Agreement2025-04-14 | 6 min

[N][T][T][N][T]

Why Now is a Smart Time to Apply for a Home Loan2025-04-14 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Understanding FMB Sketch Online in Tamil Nadu: A Comprehensive Guide2025-04-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

New Home Loan Subsidy Scheme: A Simple Guide for First-Time Homebuyers2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Kerala: A Comprehensive Guide2025-04-11 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Buying a House for the First Time? A 5-Step Guide to Help You Plan Smartly2025-04-14 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Change the Bank Account for EMI Payments2025-04-11 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding Mortgage Loan Foreclosure Charges: A Quick Guide2025-04-11 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Leased Property: Meaning, Process, and Benefits2025-04-07 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Mortgage Loan Transfer Process: A Step-by-Step Guide2025-04-07 |

loan+against+property Loan Against Property

[N][T][T][N][T]

What is a Residential Land Loan and How Does it Work?2025-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Hybrid Flexi Loan vs. Personal Loan: Which One is Better?2024-01-24 | 3 min

tax Tax

[N][T][T][N][T]

How to Claim Tax Benefits on Joint Home Loans2024-07-10 | 4 min

tax Tax

[N][T][T][N][T]

How to Avail Maximum Home Loan Tax Benefit in India in 2023?2024-05-13 | 6 min

cibil Cibil

[N][T][T][N][T]

Ways to Improve Your Credit Score with a Credit Card2024-02-02 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Terminologies2024-06-01 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Advantages for First-Time Home Buyers2023-07-14 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Eligibility Guide for PMAY Urban 2.0: Credit Linked Subsidy Scheme (CLSS) Explained2025-01-13 | 2 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

tax Tax

[N][T][T][N][T]

Can I Claim Home Loan Tax Benefits on an Under-Construction Property?2024-05-23 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

home+loan Home Loan

[N][T][T][N][T]

4 Effective Tips to Reduce Your Home Loan Interest Rate