Your Home Loan interest rate is one of the key factors that will determine how easy or stressful it will be for you to repay your loan. High-interest rates translate into high EMIs as well as high-interest outgo. On the other hand, low-interest rates make the loan as well as its EMIs affordable.

In India, most lenders offer and most borrowers choose to avail of housing loans on floating interest rates which increase with respect to Repo Rate. So, what does one do when your Home Loan EMIs become expensive? How to manage high Home Loan EMIs, if you were offered a high interest rate in the first place? This article answers this question in detail.

5 Strategies to Manage High Home Loan EMIs Effectively

1.Talk to Your Lender

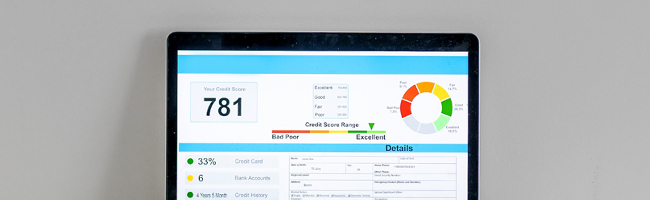

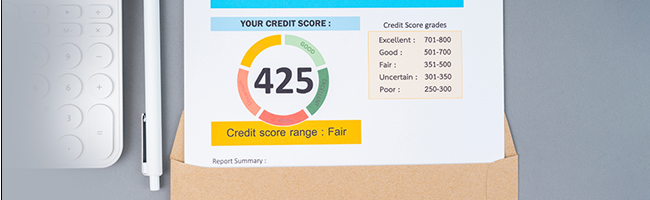

If your EMIs have suddenly gone up due to an increase in the Repo Rate and you are finding it difficult to repay them, talk to the lender about your situation and request a reduction in your Home Loan EMIs. If you have been a responsible borrower in the past, your lender will most probably consider your request. However, know that your lender will consider your request only if you have never missed an EMI payment in the past and your credit score is at least 750 or above.

2.Consider Increasing Your Loan Tenure

Your Home Loan EMI depends on three variables: interest rate, loan tenure and the rate of interest.

If your EMI has gone up due to a hike in the interest rates and clearing EMIs each month has become burdensome for you, you can make them affordable by increasing your loan tenure. However, keep in mind that when one increases their tenure, their EMIs go down but the total interest payout increases, which in turn, increases the cost of borrowing the loan. So, one must avail of this option only after careful planning and understanding all the pros and cons.

3.Consider Pre-Paying a Part of Your Loan

Lenders take a risk by lending money to borrowers, and they make up for the risk involved by charging interest on the loan. The interest is charged on the principal amount. Thus, when borrowers make prepayments or clear off a part of their loan by making a lump sum payment, lenders lose interest money. Therefore, until a few years ago, lenders used to charge hefty penalties on prepayments.

Also Read: Factors to Keep in Mind When Prepaying Your Home Loan

However, the RBI has now mandated that all individual borrowers on floating interest rate Home Loan can now make prepayments at no additional cost at any point in their loan journey. So, if your EMIs have jumped up and you have opted for the floating interest rate regime, you can consider reducing the principal amount by making a prepayment. This will also reduce your EMIs.

4.Assess and Re-assess Your Budget

If you are being forced to pay higher EMIs and there is no way for you to reduce them, go through your monthly budget and see what expenses cut you down. Use a Home Loan EMI Calculator to figure out your monthly EMI obligation and use the information to plan your monthly budget to make scope for your new EMIs.

5.Opt for a Home Loan Balance Transfer

Lastly, if nothing else works, you can consider opting for a Home Loan Balance Transfer. Home loan Balance Transfer is a facility that borrowers can use to transfer their loan from one lender to another offering better terms and conditions, such as reduced interest rates, nil prepayment and foreclosure charges, etc. This is a highly beneficial facility. However, borrowers must know that it involves a fee, which is charged as a certain percentage of the loan amount and therefore, one must opt for this facility only after doing a cost-benefit analysis. In general, a home loan balance transfer proves beneficial only when opted for during the initial years of a loan.

People Also Read: How to Calculate Home Loan EMI?

Final Words

If your Home Loan EMIs have increased suddenly due to a certain reason, know that there is no reason to be worried about it. You can consider transferring your balance to another lender and enjoy lower interest rates at better terms. Borrowers can also extend their Home Loan tenure and repay the loan conveniently. Individual borrowers can opt for pre-payment or foreclosure of their Home Loan availed at a floating rate of interest without having to pay any additional charges.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

[N][T][T][N][T]

Understanding EMI Allocation Within Your Salary2025-05-28 | 3 min

[N][T][T][N][T]

Is a Down Payment Mandatory for a Home Loan in India?2025-05-27 | 3 min

[N][T][T][N][T]

How to Buy a Home Securely under MahaRERA2025-05-27 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Valuation of House: A Comprehensive Guide for Homeowners in India2025-05-27 | 2 min

[N][T][T][N][T]

Factors That Affect Your Loan Against Property Eligibility2025-05-26 | 3 min

[N][T][T][N][T]

Why Loan Against Property Can Be an Ideal Choice for Funds2025-05-27 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Freehold vs. Leasehold Property: What You Need to Know2025-05-27 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Transferable Development Rights (TDR): Understanding the Concept2025-02-12 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Buying a Home: Understanding the 'No EMI till Possession' Scheme2025-03-19 | 2 min

home+loan Home Loan

[N][T][T][N][T]

PMAY Urban 2.0: Guidelines for Affordable Housing in India2025-01-29 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Ways to Check RERA Registration Status of Real Estate Projects2025-03-20 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

A Guide to Calculate Loan Against Property EMI2025-01-08 | 2 min

[N][T][T][N][T]

Relinquishment Deed: Meaning, Format, and Documents Required2025-03-19 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Get a Top-Up Loan After Transferring Your Home Loan2025-05-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Floor Space Index (FSI): Meaning, Calculation, and its Importance in Real Estate2025-03-20 | 2 min

home+loan Home Loan

[N][T][T][N][T]

BBMP: Full Form, History, and Role in Bangalore’s Governance2025-03-20 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Everything You Need to Know About a Co-Applicant in a Home Loan and Tax Benefits2025-03-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Should You Take a Home Loan Even If You Have Enough Money to Buy a House?2024-01-30 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Property Search Guide for First-Time Homebuyers2025-05-20 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Property: A Balanced Approach to Financing2025-05-20 | 3 min

tax Tax

[N][T][T][N][T]

How to Reduce the Loan Against Property Interest Rate?2023-12-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Making the Shift: Benefits of Moving from Pre-EMI to Full EMI in a Home Loan2025-05-20 | 4 min

cibil Cibil

[N][T][T][N][T]

Loan Rejection Impact on CIBIL Score2024-12-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Pay Off Your Home Loan Quicker2024-03-11 | 4 Min

[N][T][T][N][T]

NRI Home Loans: 5 Things to Keep in Mind Before Applying2024-02-15 | 4 min

[N][T][T][N][T]

7 Benefits of Taking a Home Loan in India2024-06-19 | 3 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

home+loan Home Loan

[N][T][T][N][T]

How to Calculate Home Loan EMIs2022-06-14 | 5 Mins

home+loan Home Loan

[N][T][T][N][T]

How to Pick the Best Home Loan Tenure that Suits Your Budget2023-06-29 | 5 min

cibil Cibil

[N][T][T][N][T]

Does CIBIL Score Affect Loan Against Property Eligibility?2023-02-15 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Secured vs Unsecured Loan - Know the Difference2023-08-24 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

5 Important Reasons to Opt for a Loan Against Property to Start Your Own Business2023-02-10 | 2 min

cibil Cibil

[N][T][T][N][T]

Ways You Can Improve your Credit Score for a Small Business2023-03-01 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Self-Employed: Three Steps to Improve Your Approval Chances2025-03-12 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Everything You Wanted to Know About Loan Against Property2023-12-16 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Step-by-Step Process How to Apply for a Loan Against Property2024-03-05 | 4 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-02-16 | 8 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top Benefits of a Loan Against Property Over Collateral-Free Loans2024-01-09 | 4 min

[N][T][T][N][T]

7 Smart Ways to Optimise Your Home Loan Interest Repayments2025-04-03 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the Benefits of a Home Loan EMI Calculator2023-07-12 | 5 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons to Maintain a Positive Credit Profile and a High CIBIL Score2023-03-01 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Professional Loans Against Property Are Financially Beneficial?2023-03-03 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan EMI Calculator Benefits and It’s Features2024-02-21 | 4 min

[N][T][T][N][T]

What is the Purpose of CIBIL Score?2023-03-25 | 4 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score & Tips To Improve It2023-02-21 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Smart Things to Consider Before You Apply for a Home Loan2022-12-14 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Loan Against Property Can be a Good Credit Option for a Startup Business?2023-12-22 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding Sale Deed in Home Loans: Why It Matters2025-05-12 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Smart Home Loan Planning After 45: Tips and Strategies2025-05-13 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Reasons Why a Housing Loan Application May Be Rejected2024-02-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Top 5 Home Loan Benefits for First-time Woman Buyers2024-05-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Choose the Best Home Loan?2023-08-09 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Tips to Avoid Rejection of Your Home Loan Application2023-08-01 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Rs.70,000 Salary: How Much Can You Borrow?2025-03-18 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loans for Salaried Employees: Eligibility, Documents, and Application Process2025-03-18 | 3 min

[N][T][T][N][T]

Home Loan for Pensioners: Eligibility and Benefits2025-03-11 | 3 min

tax Tax

[N][T][T][N][T]

How Much Tax Can be Saved Under Sections 80C, 80D, and 80G?2024-05-15 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Age to Buy a House?2025-03-19 | 2 min

tax Tax

[N][T][T][N][T]

Difference Between Old vs. New Tax Regime2024-08-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Consider These Factors Before Foreclosing Your Home Loan2024-04-16 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Mortgage Loan Underwriting Process: What You Should Know2025-05-12 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding How Home Loan Interest Rates Are Determined2025-05-12 | 5 min

[N][T][T][N][T]

5 Benefits of Availing of a Home Loan at an Early Age2024-05-10 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Home Loan2023-02-20 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What You Can Do to Improve Your CIBIL Score2023-03-16 | 4 min

tax Tax

[N][T][T][N][T]

What Does It Mean to Have a CIBIL Score of -12023-06-16 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Property Registration Charges2024-03-13 | 5 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

tax Tax

[N][T][T][N][T]

What is a Property Tax in India and How is It Calculated?2024-03-13 | 4 min

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What Is a Pre-Approved Home Loan and How Should You Get It Done?2024-03-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is an NOC Letter and Why is it Important?2024-05-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

A Guide to Loan Against Property for Doctors2022-06-27 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

What Is Home Loan Eligibility and How Is It Calculated2024-07-11 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2024-03-22 | 5 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

What Is Credit Mix and How Can It Help Your Credit Score?2023-07-12 | 3 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What Do You Need to Know About Home Loan Foreclosure?2023-03-23 | 5 min

cibil Cibil

[N][T][T][N][T]

What Are Tradelines and How to Find Them On Your Credit Report?2024-05-28 | 4 min

home+loan Home Loan

[N][T][T][N][T]

5 Great Ways Women Can Benefit from Taking a Housing Loan2024-01-16 | 5 min

cibil Cibil

[N][T][T][N][T]

5 Ways to Increase CIBIL Score After Job Loss2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

Ways to Improve Your Credit Score with a Credit Card2024-02-02 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Property for Doctors: Interest Rates and Charges2023-11-24 | 6 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding Composite Home Loans: A Smart Financing Option for Plot and Construction2025-05-08 | 3 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-04-10 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Types of Home Loan Charges2024-01-22 | 3 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top 5 Issues Regarding Loan Against Property Application Rejection that You Might Face2023-02-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Conversion Charges Explained: What They Are and When They Apply2025-05-09 | 2 min

tax Tax

[N][T][T][N][T]

Tax Benefits on Home Loans for Self-Employed Individuals: What You Need to Know2024-06-07 | 4 min

[N][T][T][N][T]

Tips to Manage Loan Against Property Repayments Efficiently2024-02-21 | 3 min

home+loan Home Loan

[N][T][T][N][T]

5 Strategies to Manage High Home Loan EMIs Effectively2023-02-22 | 6 min

cibil Cibil

[N][T][T][N][T]

Top Tips to Improve Credit Score Immediately to Get Your Loan Approved2023-03-30 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Five Tips to Choose the Right Digital Platform for Home Loans2023-02-09 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Complete Guide to Securing a Attractive Interest on Home Loans2024-01-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Section 80EE: Claim Deductions on the Home Loan Interest Paid2024-04-25 | 6 min

home+loan Home Loan

[N][T][T][N][T]

10 Smart Steps for Effective Home Loan Management2024-02-16 | 5 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

[N][T][T][N][T]

What Is the OCR in a Home Loan? A Complete Guide2025-05-09 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding SDMC Property Tax: A Guide to Online and Offline Payment Methods2025-05-08 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Mortgage Loan Against Vacant Land: A Feasible Way to Unlock Property Value2025-05-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Registration Charges in Tamil Nadu2025-05-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What Are Closing Costs? Understanding the Final Steps of a Home Purchas2025-05-07 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Need More from Your Home Loan? Here’s How You Can Optimise I2025-05-07 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Apply for a Loan Against Property Online in Bangalore?2025-05-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Transfers: Unlocking Better Rates and Terms2025-05-07 | 2 min

[N][T][T][N][T]

Decoding Credit Scores: Understanding Their Role and Impact2025-05-05 | 4 min

[N][T][T][N][T]

The CIBIL Score Advantage for Loan Approval2025-05-05 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Credit Score and High-Interest Rates: How They Can Affect Your Loan Journey2025-05-05 | 8 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding OTC and PDF in Loan Against Property2025-05-05 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Equitable Mortgage vs Registered Mortgage: Key Differences Explained2025-04-30 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Taking a Home Loan to Buy a Property for Investment? Here Are 5 Points to Consider2023-04-17 | 5 min

home+loan Home Loan

[N][T][T][N][T]

A Complete Guide on the Benefits of Joint Home Loan2022-11-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

4 Key Benefits of Home Loan Balance Transfer to Bajaj Housing Finance Limited2023-01-09 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Top Things to Keep Track of While Doing a Home Loan Balance Transfer