A Home Loan is a long-term financial commitment. Therefore, it is important that you choose a lender who aligns with your financial standing. When it comes to Home Loans, Bajaj Housing Finance is one of the most trusted names in the market. The company offers Home Loans at competitive interest rates. Their eligibility requirements are basic and documentation requirements are minimal. Further, the company is known for speedy disbursal of loans - with Bajaj Housing Finance, you can expect to see the loan amount in your account within 48 Hours* of document submission and approval. To facilitate the purchase of your dream home, apply for a housing loan with Bajaj Housing Finance.

In this article, we discuss with you some tips to help you receive quick approval on your Home Loan application from Bajaj Housing Finance.

Easy Tips on How to Get Your Loan Approved from Bajaj Housing Finance

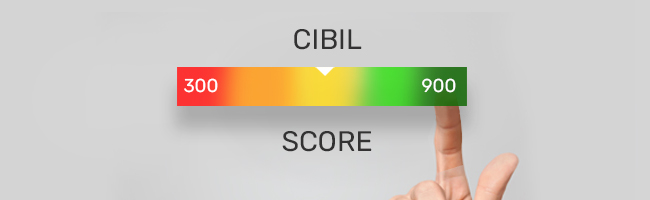

1. Make Sure You Have an Excellent Credit Score

Planning to apply for a Home Loan with Bajaj Housing Finance? Make sure your credit score is at least 750 or above. A good credit score indicates good repayment capacity as well as high creditworthiness. Lenders prefer diligently credit borrowers and approve Home Loan applicants with a high credit score. If your credit score is below 750, try improving your credit score to get approved for a Home Loan at favourable terms.

2. Check Your Credit Report for Errors Before Applying for a Home Loan

Often, a person's credit score decreases due to incorrect information supplied to credit information bureaus by financial institutions. If you are planning to apply for a Home Loan, access your credit report and make sure there are no errors in it. If you see any errors, report them immediately. Rectifying credit report errors takes time. Therefore, you should dispute these errors immediately after you identify them.

Also Read: A Helpful Guide to Understanding Your Credit Report

3. Make Sure You Have All the Documents Ready with You

Before beginning the Home Loan Application Process, go to Bajaj Housing Finance’s website and check the list of Home Loan documents you will be required to provide during the application procedure. Keep the original and photocopies of all the documents ready with you. Sometimes, applications may get rejected or put on hold due to insufficient documentation. To experience a hassle-free and smooth loan application journey, have all documents ready with you.

4. Go with a Well-Known Property Developer

Lenders exercise caution in approving applications to mitigate the risk of default. Thus, they may decline applications for properties developed by builders listed as defaulters. Opting for a renowned builder can expedite approval. Bajaj Housing Finance has over 5000 pre-approved projects. Apply for a Home Loan to buy property in one of these projects to experience quick approval as well as advantageous borrowing terms and conditions.

5. See if You Have a Pre-Approved Loan Offer

Some lenders extend pre-approved loan offers to creditworthy and eligible borrowers. If you are pre-approved for a loan, not only will your Home Loan application receive immediate approval but you will also get favourable terms and conditions on your loan. So, check if you have a pre-approved loan offer from Bajaj Housing Finance. If you have, getting your loan application approved quickly will be a cakewalk.

6. Apply for a Joint Home Loan

If you think your housing loan eligibility is low and you do not meet the Bajaj Housing Finance Home Loan eligibility criteria, you can enhance your eligibility and increase your chances of receiving loan approval by adding a financial co-applicant to your Home Loan application. However, keep in mind that this co-applicant should have an excellent credit score and a good income profile.

People Also Read: Complete Guide on the Benefits of Joint Home Loan

Final Words

Securing a Home Loan from Bajaj Housing Finance is expedited by ensuring a high credit score, rectifying any credit report errors, preparing all required documents, choosing a reputable property developer, and exploring pre-approved loan offers. Additionally, considering a joint Home Loan application can enhance eligibility and approval chances significantly. To get your Home Loan sanctioned quickly from Bajaj Housing Finance, follow the tips mentioned in this article.

*Terms and conditions apply.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

[N][T][T][N][T]

Role of Eligibility Calculator Before Availing a Home Loan2025-04-23 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Kerala: A Comprehensive Guide2025-04-11 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Use Loan Against Property EMI Calculator2025-04-23 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Property for Business: What You Should Know2025-04-22 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Can You Convert a Loan Against Property into a Home Loan? Here’s What You Need to Know2025-04-22 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Key Documents to Check for a Safe and Transparent Property Transaction2025-04-22 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Tax Benefits: Is There a Limit on How Many Times You Can Claim?2025-04-22 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

What to Know Before Availing of a Loan Against Property2025-04-22 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

What Happens When You Pay Off Your Mortgage?2025-04-22 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Pay MCD Property Tax in Delhi2025-04-21 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Tax Benefits on Mortgage Loans: What You Need to Know2025-04-21 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Apply for GPRA Accommodation via eSampada and eAwas2025-04-21 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the SVAMITVA Scheme: A New Era of Property Ownership in Rural India2025-04-21 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Property is More Than Just an Asset: 4 Ways It Can Power Your Finances2025-04-21 | 2 min

[N][T][T][N][T]

Home Loan Insurance Benefits for New Home Buyers2025-04-21 | 6 min

home+loan Home Loan

[N][T][T][N][T]

MPIGR Madhya Pradesh: A Guide to Property Registration and SAMPADA Services2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Consider These Factors Before Foreclosing Your Home Loan2024-04-16 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Top Things to Keep Track of While Doing a Home Loan Balance Transfer2022-12-18 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Smart Things to Consider Before You Apply for a Home Loan2022-12-14 | 5 min

tax Tax

[N][T][T][N][T]

How Much Tax Can be Saved Under Sections 80C, 80D, and 80G?2024-05-15 | 5 min

tax Tax

[N][T][T][N][T]

Tax Benefits on Home Loans for Self-Employed Individuals: What You Need to Know2024-06-07 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Increase Your CIBIL Score Above 800: 7 Proven Methods2023-01-24 | 4 min

home+loan Home Loan

[N][T][T][N][T]

10 Smart Steps for Effective Home Loan Management2024-02-16 | 5 min

tax Tax

[N][T][T][N][T]

Should You Get a Home Loan to Save Your Taxes?2024-02-01 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Should You Take a Home Loan Even If You Have Enough Money to Buy a House?2024-01-30 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Short vs. Long Loan Against Property Tenor - Which Is Better?2024-05-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Section 80EE: Claim Deductions on the Home Loan Interest Paid2024-04-25 | 6 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

[N][T][T][N][T]

Tips to Manage Loan Against Property Repayments Efficiently2024-02-21 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Differences Between Fixed and Floating Interest Rates2024-05-15 | 2 min

home+loan Home Loan

[N][T][T][N][T]

What Do You Need to Know About Home Loan Foreclosure?2023-03-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Monthly Reducing Balance Method for Home Loan Interest2025-02-25 | 3 min

[N][T][T][N][T]

Everything You Need to Know About Home Loan Part-Prepayment2024-12-18 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Age to Buy a House?2025-03-19 | 2 min

tax Tax

[N][T][T][N][T]

Top 5 Tax Benefits and Other Advantages of a Joint Home Loan2024-07-10 | 8 min

home+loan Home Loan

[N][T][T][N][T]

Complete Guide to Securing a Attractive Interest on Home Loans2024-01-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Pick the Best Home Loan Tenure that Suits Your Budget2023-06-29 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Check Housing Loan Eligibility with Home Loan Eligibility Calculator2023-07-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Everything You Need to Know About Top-up Loans on a Home Loan2024-04-09 | 6 min

home+loan Home Loan

[N][T][T][N][T]

A Step-by-Step Guide to Home Loan Balance Transfer Application2024-07-09 | 6 min

cibil Cibil

[N][T][T][N][T]

High CIBIL Score Helps Low-Interest Rate Loans2024-06-10 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Get a Home Loan Without Visiting Branch: A Step-by-Step Guide2024-03-20 | 4 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Balance Transfer: Benefits, Eligibility, and More2024-05-15 | 3 Min

[N][T][T][N][T]

7 Benefits of Taking a Home Loan in India2024-06-19 | 3 min

home+loan Home Loan

[N][T][T][N][T]

An Essential Guide to Refinancing a Home Loan2024-04-22 | 5 Min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Tips to Secure Quick Home Loan Approval2025-03-03 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Residential Property: A Smart Financing Solution2025-03-10 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Agricultural Land: Unlock the Value of Your Property2025-03-07 | 6 min

cibil Cibil

[N][T][T][N][T]

Know How Mortgage Loan Affect Your CIBIL Score2024-02-05 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-04-10 | 6 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loans for Salaried Employees: Eligibility, Documents, and Application Process2025-03-18 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Property Mortgage Loan: A Smart Financing Option for Businesses2025-03-10 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Calculate Your Home Loan Eligibility2025-03-05 | 3 min

[N][T][T][N][T]

Loan Against a Shop- Commercial Property Loans2024-12-18 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Home Loan2023-02-20 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

3 Different Loan Against Property Types You Should Know About2024-02-13 | 5 Min

[N][T][T][N][T]

Home Loan for Pensioners: Eligibility and Benefits2025-03-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

5 Great Ways Women Can Benefit from Taking a Housing Loan2024-01-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Self-Employed Individuals2025-03-03 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Professional Loans Against Property Are Financially Beneficial?2023-03-03 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Reasons Why a Housing Loan Application May Be Rejected2024-02-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

6 Reasons Why Collateral Matters When Applying for a Loan Against Property2023-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

Five Reasons Why a Bad Credit Score Could Lead to Loan Rejection2024-01-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Refinancing: What, Why, and Things to Remember2024-06-17 | 5 Min

cibil Cibil

[N][T][T][N][T]

Top 10 Reasons For Low CIBIL Score & How To Improve It2024-03-01 | 5 min

[N][T][T][N][T]

What is the Purpose of CIBIL Score?2023-03-25 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Joint Home Loan with your Spouse2023-08-04 | 4 min

home+loan Home Loan

[N][T][T][N][T]

What is the Process to Get Your Home Loan Approved Fast with Bajaj Housing Finance?2024-02-15 | 6 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Easy Ways to Pick the Right Loan Against Property Tenor2024-05-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Pay-off Your Debt with Bajaj Housing Finance Loan Against Property2024-02-14 | 5 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Report Errors and How to Fix Them_WC2023-07-11 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Common Mistakes You Must Avoid Making When Applying for a Loan Against Property2023-02-09 | 5 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Making Financial Planning Easy with a Home Loan EMI Calculator2023-09-06 | 2 min

cibil Cibil

[N][T][T][N][T]

Reasons to Maintain a Positive Credit Profile and a High CIBIL Score2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Will a Loan Settlement Ruin My CIBIL Score?2023-03-21 | 4 min

[N][T][T][N][T]

Loan Against Property or A Home Loan: Know What You Need2024-06-11 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Loan Against Property Can be a Good Credit Option for a Startup Business?2023-12-22 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top Benefits of Loan Against Property Over Collateral-free Loans2023-02-23 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Everything You Wanted to Know About Loan Against Property2023-12-16 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Taking a Home Loan to Buy a Property for Investment? Here Are 5 Points to Consider2023-04-17 | 5 min

home+loan Home Loan

[N][T][T][N][T]

4 Key Benefits of Home Loan Balance Transfer to Bajaj Housing Finance Limited2023-01-09 | 5 min

cibil Cibil

[N][T][T][N][T]

Is a Good CIBIL Score Mandatory for Home Loan Approval?2023-02-17 | 4 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

tax Tax

[N][T][T][N][T]

Income Tax Structure in New Regime: New Tax Exemption Limit 20252024-05-08 | 4 min

tax Tax

[N][T][T][N][T]

8 Useful Income Tax Exemptions for Salaried Employees2024-04-18 | 7 min

home+loan Home Loan

[N][T][T][N][T]

What Affects the Interest Rate on Your Home Loan2024-03-13 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Importance of an NOC Letter after Closing Your Home Loan2023-12-14 | 6 min

home+loan Home Loan

[N][T][T][N][T]

The Importance of a Home Loan NOC2023-01-31 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Importance Of a Good Credit Score in The Home Loan Process2023-03-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

6 Ways to Reduce Your Home Loan Interest2024-03-20 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Apply for a Mortgage Loan?2025-03-05 | 3 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

[N][T][T][N][T]

What are Tranche Disbursement and Tranche EMI in Home Loans?2025-03-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Down Payment for a Home Loan?2024-05-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Pay Off Your Home Loan Quicker2024-03-11 | 4 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding Loan-to-Value Ratio (LTV) and its Calculation2023-11-28 | 4 Min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Home Loan Settlement: What You Need to Know2025-03-13 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Types of Collateral Properties2024-12-26 | 4 min

[N][T][T][N][T]

Checklist of Documents Required for Home Loan2024-02-07 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact Of a Co-Applicant’s CIBIL Score On Your Home Loan Application2023-01-20 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Gujarat2025-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

All You Should Know About Home Loan Disbursement and Sanctioning Process2024-03-19 | 3 Min

home+loan Home Loan

[N][T][T][N][T]

Difference Between Co-owner, Co-borrower, Co-Applicant, and Co-Signer in Home Loan2023-08-31 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What is an NOC Letter and Why is it Important?2024-05-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Can I Take a Home Loan and a Personal Loan Together?2024-01-17 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Top 5 Home Loan Benefits for First-time Woman Buyers2024-05-14 | 5 min

tax Tax

[N][T][T][N][T]

10 Useful Income Tax Deductions for FY 2022-232024-02-21 | 6 min

home+loan Home Loan

[N][T][T][N][T]

6 Point Differentiation Between Home Loan Vs Home Construction Loan2023-02-15 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

MCGM Property Tax Mumbai: Online Payment, Calculation, and Exemptions Explained2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Domicile Certificate: Meaning, Documents, and How to Apply Online2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Equitable Mortgage vs Registered Mortgage: Key Differences Explained2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Home Loan Processing Time: What to Expect and How to Prepare