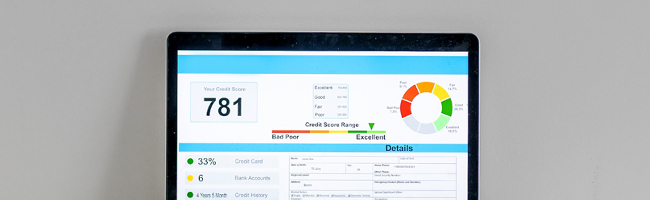

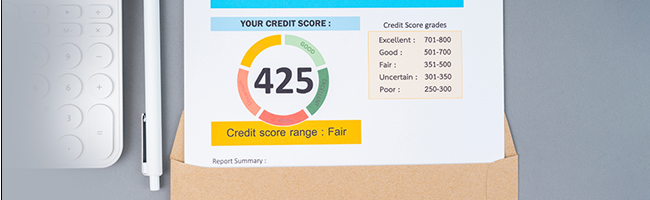

In today's world, individuals can avail of loans and credit cards to fulfil their financial goals. A key factor in accessing credit is the CIBIL Score, which reflects a person's creditworthiness through a three-digit number assigned by CIBIL. Banks and financial institutions typically require an ideal credit score to extend loans at lucrative terms. Your credit score is based on past borrowing and repayment habits.

What is a Late Payment?

A payment that is not made by the due date agreed upon by the borrower and the lender, is considered late. Late payments can lower a borrower's credit score and make it challenging for them to get loans in the future. To avoid damaging your credit score, it's important to check your CIBIL score and complete all your transactions on time.

How Does Late Payment Affect CIBIL Score?

Yes, but before getting into what affects a CIBIL score, let us discuss what a CIBIL score is. A CIBIL score is a three-digit numerical summary of your credit history, rating, and report that varies from 300 to 900.

Late payments can have several detrimental effects on a borrower's credit score and future ability to get credit. Following are some of the possible effects of late payments:

- Negative effects on credit scores: When assessing your loan application, lenders may specifically look for late payments recorded in your credit report. Late payments can decrease a borrower's credit score.

- Difficulty in getting credit: Having a history of late payments can make it challenging for a borrower to qualify for a loan or credit card. Even if the borrower is granted a loan or a credit card, they may have to pay a higher interest.

- Increased default risk: Late payments generally indicate financial instability and may be seen as a risk by the lenders. Consequently, a borrower may find it challenging to get credit in the future.

- Negative effect on the credit report: Late payments are reported to credit bureaus and will show up on the credit report of the borrower. This may affect the borrower's capacity to avail of loans at favourable interest rates.

- Difficulty in recovering a low CIBIL score: After getting a late payment remark, borrowers may experience difficulties in improving their credit score. In such circumstances, it becomes important for them to practice prudent credit behaviour.

Impact of Late Payments on Credit Score Based on the Duration of Delay

Late payments can lower your credit score, with the impact depending on how long the payment remains overdue. Here is how different delays may affect your score:

- 30 Days Late: A single late payment of 30 days can reduce your credit score by 50–80 points, depending on your overall credit profile. If paid immediately, the impact is relatively short-term.

- 60 Days Late: If a payment is overdue by 60 days, the score drop can range between 50–100 points.

- 90 Days Late: A 90-day delay can lead to a 100–150 point drop in your score. At this stage, the late payment is reported as a serious delinquency and remains on your credit report for up to seven years.

- 120+ Days Late: Payments delayed beyond 120 days may lead to a 150+ point reduction, with the account potentially being classified as a default or sent to collections. This can make future credit approvals more challenging.

What Steps Should You Take to Avoid Late Payments?

Timely payments are important for maintaining a good credit score and financial stability. Here are some effective steps to ensure you never miss a due date:

- Set Up Automatic Payments: Enabling auto-debit for your loan EMIs and credit card bills ensures payments are made on time, reducing the risk of missing due dates.

- Use Payment Reminders: Set up alerts via SMS, email, or mobile apps to remind you of upcoming payments.

- Prioritise Debt Repayments: Plan your expenses wisely, ensuring essential payments like loan EMIs and credit card bills are covered before discretionary spending.

Minor and Major Payment Defaults

Payment defaults are divided into two categories: minor and major.

Minor Default: When a borrower misses or delays payment for less than 90 days, this is considered a minor payment default. Banks and lenders consider such defaults to be minor because they believe they will be resolved quickly. However, the CIBIL score is temporarily impacted in this case.

Major Default: When the borrower pays the credit amount but does so after 90 days, this is considered a major payment default. As a result, the CIBIL score suffers more. Also, major payment defaults along with low CIBIL scores hinder future loan or credit card approval.

The exact impact however depends on factors such as the length of the delinquency, the amount of the missed payment, and how recently the payment was missed. The frequency, severity and recency of missed payments can affect your credit score in different ways.

Impact of a Missed Payment on CIBIL Score

Here's how a missed payment can affect you:

Decrease in credit score:

Missed payments can lead to a drop in your credit score. Payment history accounts for a significant portion of your credit score, thus, a missed payment can have a significant impact on your creditworthiness.

Late payment fees and interest charges:

If you fail to make a payment on time, you may be charged late payment fees and interest. These fees and charges add up to the outstanding loan amount which increases the overall cost of borrowing.

Difficulty in obtaining credit:

Missed payments can make future credit applications more difficult, as lenders may be less willing to extend credit to you.

Higher Interest Rates:

If you are approved for credit despite having missed payments on your credit report, you may get offered higher interest rates, making borrowing more expensive.

Negative impact on credit report:

Missed payments can stay on your credit report for up to 7 years, which can have a negative impact on your creditworthiness during that time.

What is 'Day Past Due' (DPD)?

Day Past Due (DPD) indicates how many days you've missed making a payment on your loan or credit card. If you have previously made on-time payments, your DPD will be listed as '0'. If you are 30 days late with your payment, your report will reflect '30' against the preceding month.

There may be instances in the Day Past Due section when 'XXX' is stated. It signifies that the lender has not submitted the bank with payment history information. If you notice it on your credit report, you should not be concerned as it does not affect your future possibilities of getting a loan or credit card approval.

Tips to Maintain a Good Credit History

You can take measures to prevent late payments and maintain a good credit history. You can avoid late payments by following these instructions:

- Set up automatic payments: Several lenders give you the option of setting up automated payments, ensuring timely payments. Essentially, this means that you leave standing instructions to your bank that the bills are to be cleared on a certain day of the calendar month.

- Use a datebook or reminder system: To help you remember when payments are due, mark the dates for all your bills on a calendar and/or set up phone or email reminders.

- Sustain a budget: Check whether you have enough disposable income in your account to pay all of your expenses and adjust your spending as necessary to prevent going overboard and defaulting payments.

- Talk to your creditors: In case you are having trouble paying a bill, get in touch with your lenders as soon as you can to let them know and to discuss alternative payment solutions.

Conclusion

A clean credit history can increase your chances of getting approved for loans such as a housing loan, business loan, or loan against property. To ensure you are credit-conscious and prepared for loans when you need them, keep an eye on your credit report frequently. If you find any incorrect information on your credit report, raise it with CIBIL and have it rectified.

Frequently Asked Questions

Yes, even a single late payment can lower a credit score, as payment history is a significant factor in CIBIL score calculations. The impact depends on factors such as the delay duration, the missed payment amount, and the borrower’s overall credit history.

Late payments generally remain on a credit report unless they are reported in error. If incorrect, a dispute can be raised with CIBIL to rectify the mistake.

A late payment can stay on a credit report for up to seven years and can impact future loan approvals and interest rates.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

home+loan Home Loan

[N][T][T][N][T]

Understanding Sale Deed in Home Loans: Why It Matters2025-05-12 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Smart Home Loan Planning After 45: Tips and Strategies2025-05-13 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Reasons Why a Housing Loan Application May Be Rejected2024-02-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Top 5 Home Loan Benefits for First-time Woman Buyers2024-05-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Choose the Best Home Loan?2023-08-09 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Tips to Avoid Rejection of Your Home Loan Application2023-08-01 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Rs.70,000 Salary: How Much Can You Borrow?2025-03-18 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loans for Salaried Employees: Eligibility, Documents, and Application Process2025-03-18 | 3 min

[N][T][T][N][T]

Home Loan for Pensioners: Eligibility and Benefits2025-03-11 | 3 min

tax Tax

[N][T][T][N][T]

How Much Tax Can be Saved Under Sections 80C, 80D, and 80G?2024-05-15 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Age to Buy a House?2025-03-19 | 2 min

tax Tax

[N][T][T][N][T]

Difference Between Old vs. New Tax Regime2024-08-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Consider These Factors Before Foreclosing Your Home Loan2024-04-16 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Mortgage Loan Underwriting Process: What You Should Know2025-05-12 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding How Home Loan Interest Rates Are Determined2025-05-12 | 5 min

[N][T][T][N][T]

5 Benefits of Availing of a Home Loan at an Early Age2024-05-10 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Home Loan2023-02-20 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What You Can Do to Improve Your CIBIL Score2023-03-16 | 4 min

tax Tax

[N][T][T][N][T]

What Does It Mean to Have a CIBIL Score of -12023-06-16 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the Benefits of a Home Loan EMI Calculator2023-07-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Property Registration Charges2024-03-13 | 5 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

tax Tax

[N][T][T][N][T]

What is a Property Tax in India and How is It Calculated?2024-03-13 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Secured vs Unsecured Loan - Know the Difference2023-08-24 | 2 min

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What Is a Pre-Approved Home Loan and How Should You Get It Done?2024-03-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is an NOC Letter and Why is it Important?2024-05-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

A Guide to Loan Against Property for Doctors2022-06-27 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

What Is Home Loan Eligibility and How Is It Calculated2024-07-11 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2024-03-22 | 5 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

What Is Credit Mix and How Can It Help Your Credit Score?2023-07-12 | 3 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What Do You Need to Know About Home Loan Foreclosure?2023-03-23 | 5 min

cibil Cibil

[N][T][T][N][T]

What Are Tradelines and How to Find Them On Your Credit Report?2024-05-28 | 4 min

home+loan Home Loan

[N][T][T][N][T]

5 Great Ways Women Can Benefit from Taking a Housing Loan2024-01-16 | 5 min

cibil Cibil

[N][T][T][N][T]

5 Ways to Increase CIBIL Score After Job Loss2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

Ways to Improve Your Credit Score with a Credit Card2024-02-02 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Property for Doctors: Interest Rates and Charges2023-11-24 | 6 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding Composite Home Loans: A Smart Financing Option for Plot and Construction2025-05-08 | 3 min

cibil Cibil

[N][T][T][N][T]

Ways You Can Improve your Credit Score for a Small Business2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-04-10 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Types of Home Loan Charges2024-01-22 | 3 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top 5 Issues Regarding Loan Against Property Application Rejection that You Might Face2023-02-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Conversion Charges Explained: What They Are and When They Apply2025-05-09 | 2 min

tax Tax

[N][T][T][N][T]

Tax Benefits on Home Loans for Self-Employed Individuals: What You Need to Know2024-06-07 | 4 min

[N][T][T][N][T]

Tips to Manage Loan Against Property Repayments Efficiently2024-02-21 | 3 min

home+loan Home Loan

[N][T][T][N][T]

5 Strategies to Manage High Home Loan EMIs Effectively2023-02-22 | 6 min

cibil Cibil

[N][T][T][N][T]

Top Tips to Improve Credit Score Immediately to Get Your Loan Approved2023-03-30 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Five Tips to Choose the Right Digital Platform for Home Loans2023-02-09 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Complete Guide to Securing a Attractive Interest on Home Loans2024-01-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Section 80EE: Claim Deductions on the Home Loan Interest Paid2024-04-25 | 6 min

home+loan Home Loan

[N][T][T][N][T]

10 Smart Steps for Effective Home Loan Management2024-02-16 | 5 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

tax Tax

[N][T][T][N][T]

How to Reduce the Loan Against Property Interest Rate?2023-12-11 | 3 min

[N][T][T][N][T]

What Is the OCR in a Home Loan? A Complete Guide2025-05-09 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding SDMC Property Tax: A Guide to Online and Offline Payment Methods2025-05-08 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Mortgage Loan Against Vacant Land: A Feasible Way to Unlock Property Value2025-05-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Registration Charges in Tamil Nadu2025-05-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What Are Closing Costs? Understanding the Final Steps of a Home Purchas2025-05-07 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Need More from Your Home Loan? Here’s How You Can Optimise I2025-05-07 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Apply for a Loan Against Property Online in Bangalore?2025-05-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Transfers: Unlocking Better Rates and Terms2025-05-07 | 2 min

[N][T][T][N][T]

Decoding Credit Scores: Understanding Their Role and Impact2025-05-05 | 4 min

[N][T][T][N][T]

The CIBIL Score Advantage for Loan Approval2025-05-05 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Credit Score and High-Interest Rates: How They Can Affect Your Loan Journey2025-05-05 | 8 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding OTC and PDF in Loan Against Property2025-05-05 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Equitable Mortgage vs Registered Mortgage: Key Differences Explained2025-04-30 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Taking a Home Loan to Buy a Property for Investment? Here Are 5 Points to Consider2023-04-17 | 5 min

home+loan Home Loan

[N][T][T][N][T]

A Complete Guide on the Benefits of Joint Home Loan2022-11-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

4 Key Benefits of Home Loan Balance Transfer to Bajaj Housing Finance Limited2023-01-09 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Top Things to Keep Track of While Doing a Home Loan Balance Transfer2022-12-18 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Importance Of a Good Credit Score in The Home Loan Process2023-03-20 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Transform Your Space with a Loan Against Property for Home Renovation2024-12-26 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

A Guide to Calculate Loan Against Property EMI2025-01-08 | 2 min

[N][T][T][N][T]

7 Smart Ways to Optimise Your Home Loan Interest Repayments2025-04-03 | 3 min

[N][T][T][N][T]

How to Choose the Right Home Loan2024-11-26 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Determine Your Ideal Credit Score for a Home Loan?2024-03-28 | 4 min

[N][T][T][N][T]

Top 3 Reasons to Buy a Home Before You Reach 302024-12-11 | 3 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score for Achieving Business Goals2024-03-13 | 5 min

[N][T][T][N][T]

3 Ways to Reduce Your EMIs with a Home Loan Balance Transfer2024-05-08 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Calculate Your Home Loan Eligibility2025-03-05 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top Benefits of Loan Against Property Over Collateral-free Loans2023-02-23 | 3 min

cibil Cibil

[N][T][T][N][T]

7 Tips to Help You Improve Your CIBIL Score2024-05-15 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Factors Determining Your Home Loan Eligibility2024-03-13 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

What Are the Eligibility Criteria for Obtaining a Loan Against Property?2023-03-28 | 4 min

[N][T][T][N][T]

Everything You Must Know About NRI Home Loans2024-02-16 | 3 min

tax Tax

[N][T][T][N][T]

How to Save Tax for Salary Above 30 Lakh?2023-08-07 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

6 Reasons Why Collateral Matters When Applying for a Loan Against Property2023-02-27 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Easy Ways to Pick the Right Loan Against Property Tenure2024-05-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Pay-off Your Debt with Bajaj Housing Finance Loan Against Property2024-02-14 | 5 min

[N][T][T][N][T]

5 Ways Home Loan Borrowers Can Lower their Home Loan EMI2023-01-04 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Tax Benefits: Is There a Limit on How Many Times You Can Claim?2025-04-22 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Gujarat2025-04-11 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-02-16 | 8 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Benefits of Loan Against Property EMI Calculator2024-12-03 | 3 min

home+loan Home Loan

[N][T][T][N][T]

All You Need to Know About Home Loans2023-01-19 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Should I Apply for a Pre-Approved Home Loan or an After Property Finalisation Loan?2024-03-15 | 5 min

home+loan Home Loan

[N][T][T][N][T]

3 Smart Tips for Refinancing Your Home Loan2024-12-03 | 3 min

[N][T][T][N][T]

NRI vs. Indian Resident Home Loans2025-03-13 | 2 min

[N][T][T][N][T]

Home Loan Overdraft Facility: Features and Benefits2025-03-19 | 3 min

[N][T][T][N][T]

Loan Against Property or A Home Loan: Know What You Need2024-06-11 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Refinancing: What, Why, and Things to Remember2024-06-17 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Common Mistakes You Must Avoid Making When Applying for a Loan Against Property2023-02-09 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Pick the Best Home Loan Tenure that Suits Your Budget2023-06-29 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan EMI Calculator Benefits and It’s Features2024-02-21 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Making Financial Planning Easy with a Home Loan EMI Calculator2023-09-06 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Everything You Wanted to Know About Loan Against Property2023-12-16 | 5 Min

tax Tax

[N][T][T][N][T]

Top 5 Tax Benefits and Other Advantages of a Joint Home Loan2024-07-10 | 8 min

[N][T][T][N][T]

6 Smart Tips to Increase Your Home Loan Eligibility2024-06-27 | 4 min

cibil Cibil

[N][T][T][N][T]

High CIBIL Score Helps Low-Interest Rate Loans2024-06-10 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top Benefits of a Loan Against Property Over Collateral-Free Loans2024-01-09 | 4 min

home+loan Home Loan

[N][T][T][N][T]

All About Home Loan Balance Transfers2024-06-04 | 4 mins

home+loan Home Loan

[N][T][T][N][T]

Common Myths About Home Loans: All You Need to Know2024-04-08 | 5 min

[N][T][T][N][T]

Loan Against Property for Doctors: An Essential Checklist