Getting a Second Home Loan

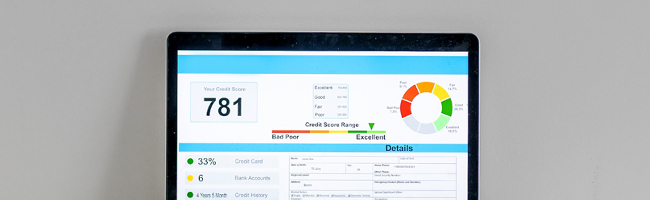

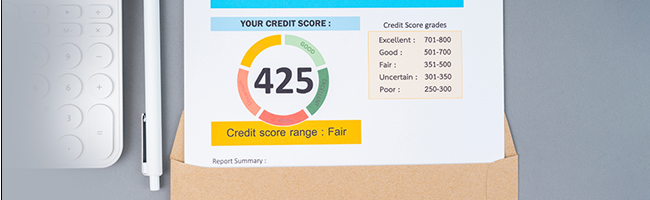

While it is possible to get a second Home Loan, it depends on your credit score and ongoing financial obligations. Applying for a second Home Loan is not very different from applying for the first Home Loan. However, borrowers are usually advised to repay their first Home Loan before taking on a second. A clear repayment capacity is a good indicator of your eligibility for a second Home Loan.

There are exceptions but taking a second Home Loan while still paying the EMIs for your first Home Loan may limit your Home Loan eligibility. Use a Home Loan Eligibility Calculator or a Home Loan EMI Calculator to assess your repayment capacity before making your second Home Loan application.

Read on to learn more about the requirements for a second Home Loan, the tax benefits, and the Home Loan eligibility.

Ideal Lender for a Second Home Loan

You can apply for a second Home Loan with your current lender or with a new lender altogether. Whoever you choose to proceed with, ensure that you’re aware of their terms and conditions and the parameters you need to meet, to be approved for a second Home Loan of your choice.

Additional Link: A Quick Guide to Securing a Better Interest on Home Loans

Quick Tips for Seeking a Second Home Loan

Here are some factors to consider while applying for a second Home Loan:

- Take stock of your current EMI and financial obligations to chalk out your repayment schedule.

- Be prepared to put down a higher down payment on your property, as your risk assessment may be higher through the lender’s profiling.

- Consider the other costs of borrowing a Home Loan, such as the processing and sanction letter fees.

Documents Required for a Second Home Loan

The documents required for a second Home Loan are:

- Mandatory documents such as PAN Card or Form 60

- Proof of identity (Voter’s ID or Aadhaar Card)

- Proof of income (3 month’s salary slips for salaried and professional individuals and proof of income from the existing business for self-employed individuals)

- P&L statement (for self-employed applicants only)

- Property documents

Note: This list is indicative. Additional documents may be needed during loan processing.

Tax Benefits on a Second Home Loan

Individuals seeking to avail of a second Home Loan can claim tax deductions of up to Rs.1.5 Lakh on the principal amount and Rs.2 Lakh on the interest payments. These tax benefits can be claimed under Section 80C and Section 24(b), respectively.

Additional Link: Top Five Ways to Manage Your Home Loan Better

*Terms and conditions apply.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

home+loan Home Loan

[N][T][T][N][T]

Know About CTS Number When Buying a Property in Mumbai2025-03-04 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Estimating Your Monthly Outgo on a Rs.1 Crore Home Loan2025-05-30 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How Can You Get a Place of Your Own When Living in a Metro City?2025-05-30 | 3 min

[N][T][T][N][T]

Home Loan ROI Explained: What it Means2025-05-30 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Understanding CIBIL MSME Rank: What it Means for Your Business Loan Application2025-05-30 | 3 min

[N][T][T][N][T]

What are Tranche Disbursement and Tranche EMI in Home Loans?2025-03-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Top Up your Home Loan2025-03-04 | 3 min

[N][T][T][N][T]

7 Smart Ways to Optimise Your Home Loan Interest Repayments2025-04-03 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Home Loan Processing Time: What to Expect and How to Prepare2025-04-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

5 Great Ways Women Can Benefit from Taking a Housing Loan2024-01-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Tips to Secure Quick Home Loan Approval2025-03-03 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Consider These Factors Before Foreclosing Your Home Loan2024-04-16 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Pre-EMI or Full EMI: Understanding Home Loan Repayment Options2025-01-16 |

home+loan Home Loan

[N][T][T][N][T]

How Much Home Loan Can I Get? A Guide for First-Time Borrowers2025-04-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Self-Employed Individuals2025-03-03 | 2 min

[N][T][T][N][T]

Smart Ways to Pay Off Your Home Loan Faster2025-04-01 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Prepayment: Everything You Need to Know2025-04-07 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Smart Home Loan Planning After 45: Tips and Strategies2025-05-13 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Need More from Your Home Loan? Here’s How You Can Optimise I2025-05-07 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding How Home Loan Interest Rates Are Determined2025-05-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

An Essential Guide to Refinancing a Home Loan2024-04-22 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding RERA in Real Estate: Meaning, Full Form, and Benefits2025-02-16 | 2 min

home+loan Home Loan

[N][T][T][N][T]

MPIGR Madhya Pradesh: A Guide to Property Registration and SAMPADA Services2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

A Guide to Applying for DTCP Approval for Patta Land Online2025-01-13 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Khasra Number Explained: How to Find It2025-01-03 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Gift Deeds: A Comprehensive Guide to Registration and Documentation2025-01-29 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Bigha in India: Convert 1 Bigha to Square Feet, Acres, and Hectares2025-01-31 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Pre-Closure: Is it the Right Step for You?2025-05-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding APF Number and Its Role in Home Loan Applications2025-01-07 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding Repayment Terms for Loans Against Property2025-05-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Smart Steps for Purchasing Property from an NRI: A Guide2025-05-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What Does It Mean to Be a Guarantor? Understanding Roles and Responsibilities2025-05-28 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Home Loan Fees and Charges in India2025-05-28 | 3 min

[N][T][T][N][T]

Understanding EMI Allocation Within Your Salary2025-05-28 | 3 min

[N][T][T][N][T]

Is a Down Payment Mandatory for a Home Loan in India?2025-05-27 | 3 min

[N][T][T][N][T]

How to Buy a Home Securely under MahaRERA2025-05-27 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Valuation of House: A Comprehensive Guide for Homeowners in India2025-05-27 | 2 min

[N][T][T][N][T]

Factors That Affect Your Loan Against Property Eligibility2025-05-26 | 3 min

[N][T][T][N][T]

Why Loan Against Property Can Be an Ideal Choice for Funds2025-05-27 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Freehold vs. Leasehold Property: What You Need to Know2025-05-27 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Transferable Development Rights (TDR): Understanding the Concept2025-02-12 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Buying a Home: Understanding the 'No EMI till Possession' Scheme2025-03-19 | 2 min

home+loan Home Loan

[N][T][T][N][T]

PMAY Urban 2.0: Guidelines for Affordable Housing in India2025-01-29 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Ways to Check RERA Registration Status of Real Estate Projects2025-03-20 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

A Guide to Calculate Loan Against Property EMI2025-01-08 | 2 min

[N][T][T][N][T]

Relinquishment Deed: Meaning, Format, and Documents Required2025-03-19 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Get a Top-Up Loan After Transferring Your Home Loan2025-05-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Floor Space Index (FSI): Meaning, Calculation, and its Importance in Real Estate2025-03-20 | 2 min

home+loan Home Loan

[N][T][T][N][T]

BBMP: Full Form, History, and Role in Bangalore’s Governance2025-03-20 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Everything You Need to Know About a Co-Applicant in a Home Loan and Tax Benefits2025-03-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Should You Take a Home Loan Even If You Have Enough Money to Buy a House?2024-01-30 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Property Search Guide for First-Time Homebuyers2025-05-20 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Property: A Balanced Approach to Financing2025-05-20 | 3 min

tax Tax

[N][T][T][N][T]

How to Reduce the Loan Against Property Interest Rate?2023-12-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Making the Shift: Benefits of Moving from Pre-EMI to Full EMI in a Home Loan2025-05-20 | 4 min

cibil Cibil

[N][T][T][N][T]

Loan Rejection Impact on CIBIL Score2024-12-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Pay Off Your Home Loan Quicker2024-03-11 | 4 Min

[N][T][T][N][T]

NRI Home Loans: 5 Things to Keep in Mind Before Applying2024-02-15 | 4 min

[N][T][T][N][T]

7 Benefits of Taking a Home Loan in India2024-06-19 | 3 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

home+loan Home Loan

[N][T][T][N][T]

How to Calculate Home Loan EMIs2022-06-14 | 5 Mins

home+loan Home Loan

[N][T][T][N][T]

How to Pick the Best Home Loan Tenure that Suits Your Budget2023-06-29 | 5 min

cibil Cibil

[N][T][T][N][T]

Does CIBIL Score Affect Loan Against Property Eligibility?2023-02-15 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Secured vs Unsecured Loan - Know the Difference2023-08-24 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

5 Important Reasons to Opt for a Loan Against Property to Start Your Own Business2023-02-10 | 2 min

cibil Cibil

[N][T][T][N][T]

Ways You Can Improve your Credit Score for a Small Business2023-03-01 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Self-Employed: Three Steps to Improve Your Approval Chances2025-03-12 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Everything You Wanted to Know About Loan Against Property2023-12-16 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Step-by-Step Process How to Apply for a Loan Against Property2024-03-05 | 4 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-02-16 | 8 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top Benefits of a Loan Against Property Over Collateral-Free Loans2024-01-09 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the Benefits of a Home Loan EMI Calculator2023-07-12 | 5 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons to Maintain a Positive Credit Profile and a High CIBIL Score2023-03-01 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Professional Loans Against Property Are Financially Beneficial?2023-03-03 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan EMI Calculator Benefits and It’s Features2024-02-21 | 4 min

[N][T][T][N][T]

What is the Purpose of CIBIL Score?2023-03-25 | 4 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score & Tips To Improve It2023-02-21 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Smart Things to Consider Before You Apply for a Home Loan2022-12-14 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Loan Against Property Can be a Good Credit Option for a Startup Business?2023-12-22 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding Sale Deed in Home Loans: Why It Matters2025-05-12 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Reasons Why a Housing Loan Application May Be Rejected2024-02-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Top 5 Home Loan Benefits for First-time Woman Buyers2024-05-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Choose the Best Home Loan?2023-08-09 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Tips to Avoid Rejection of Your Home Loan Application2023-08-01 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Rs.70,000 Salary: How Much Can You Borrow?2025-03-18 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loans for Salaried Employees: Eligibility, Documents, and Application Process2025-03-18 | 3 min

[N][T][T][N][T]

Home Loan for Pensioners: Eligibility and Benefits2025-03-11 | 3 min

tax Tax

[N][T][T][N][T]

How Much Tax Can be Saved Under Sections 80C, 80D, and 80G?2024-05-15 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Age to Buy a House?2025-03-19 | 2 min

tax Tax

[N][T][T][N][T]

Difference Between Old vs. New Tax Regime2024-08-22 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Mortgage Loan Underwriting Process: What You Should Know2025-05-12 | 3 min

[N][T][T][N][T]

5 Benefits of Availing of a Home Loan at an Early Age2024-05-10 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Home Loan2023-02-20 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What You Can Do to Improve Your CIBIL Score2023-03-16 | 4 min

tax Tax

[N][T][T][N][T]

What Does It Mean to Have a CIBIL Score of -12023-06-16 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Property Registration Charges2024-03-13 | 5 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

tax Tax

[N][T][T][N][T]

What is a Property Tax in India and How is It Calculated?2024-03-13 | 4 min

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What Is a Pre-Approved Home Loan and How Should You Get It Done?2024-03-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is an NOC Letter and Why is it Important?2024-05-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

A Guide to Loan Against Property for Doctors2022-06-27 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

What Is Home Loan Eligibility and How Is It Calculated2024-07-11 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2024-03-22 | 5 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

What Is Credit Mix and How Can It Help Your Credit Score?2023-07-12 | 3 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What Do You Need to Know About Home Loan Foreclosure?2023-03-23 | 5 min

cibil Cibil

[N][T][T][N][T]

What Are Tradelines and How to Find Them On Your Credit Report?2024-05-28 | 4 min

cibil Cibil

[N][T][T][N][T]

5 Ways to Increase CIBIL Score After Job Loss2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

Ways to Improve Your Credit Score with a Credit Card2024-02-02 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Property for Doctors: Interest Rates and Charges