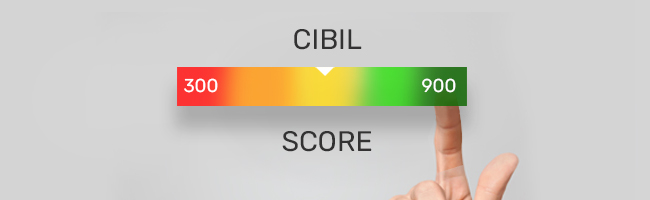

Four credit information bureaus operate in India – Equifax, Experian, CRIF High Mark, and Credit Information Bureau Limited (CIBIL). These credit bureaus collect information about borrowers, which is like a portrait defining various aspects such as borrower’s punctuality in the payment of their EMIs and credit card dues, their debt-to-income ratio, their debt obligations, their fixed-obligation-to-income ratio and so on. Based on these parameters, these credit information bureaus prepare credit reports and assign credit scores to borrowers.

Of these four credit information bureaus, TransUnion CIBIL is the most well-recognised and well-trusted. In fact, most lenders operating in India work with CIBIL to understand a potential borrower’s creditworthiness and repayment capacity. The credit rating given by CIBIL is known as the CIBIL Score.

Loan applicants must check their CIBIL score before applying for a loan so that they can take corrective measures in case their CIBIL score does not meet their lender’s qualifying criteria. The question however is: how does one check CIBIL score online? This brief guide answers this very question. So, read on.

How Can I Check My CIBIL Score?

You can check their CIBIL score online on the official website of CIBIL by paying a nominal fee or by visiting your preferred lender's website, which allows borrowers to check CIBIL for free.

Method 1: Through the Official Website of CIBIL

The first method requires a borrower to go to the website of TransUnion CIBIL and fill out an application form in these steps:

- Sign up and create an account.

- Once you have created an account, request to get access to your credit report by filling out an application form. In the form, you will be required to disclose details, such as your phone number and email address.

- Pay a nominal fee.

- Once you have made the payment, TransUnion CIBIL will send you your elaborate credit report on your registered email ID.

People Also Read: How to Check and Improve CIBIL Score?

Method 2: Through Any Lender's Website

Borrowers can also check their credit score through any lender's website, which offers this service. By using these websites, applicants can check their CIBIL score multiple times without paying any fee. The information you provide here will remain safe with the operators of the website and security won’t be an issue. All you have to do is register with the website using your phone number and OTP. Once you have done that, you can check your CIBIL score using either your PAN Card or Aadhaar details.

A. By Using Your PAN Card

You can do a CIBIL score check free online by PAN number. These websites ask for an applicant’s PAN details as these details allow these companies to access an individual’s credit records accurately. If you are using your PAN details to check your credit score, make sure to enter all details accurately – all details you enter on the website should match the details on your PAN Card.

Next, follow these steps to check your CIBIL score online using your PAN details:

- Go to a trustworthy website that allows you to check your CIBIL score online for free.

- Create an account and look for an option to check your CIBIL score.

- Enter details, such as name and date of birth as per those given in your PAN Card.

- You will also be required to enter your phone number, residential address, and mobile number.

- Submit and you will see your credit score on the screen.

Note that the steps may vary based on the lender.

Also Read: How to Check CIBIL Score with PAN Card for Free in 3 Steps

B. By using Your Aadhaar Card

If you want to check your CIBIL score using Aadhaar, follow these steps:

- Create an account on your preferred website and look for the credit score download option.

- Enter details, such as name and date of birth according to your Aadhaar.

- Press submit and you should see your credit score on the screen right after.

Note that the steps to check your CIBIL score using an Aadhaar Card may vary based on the lender.

Those planning to avail of a loan should get their credit report at least six months in advance. This will give them ample time to report issues and errors as well as take corrective measures in case their credit score does not meet their lender's eligibility requirements. These days, it has become quite easy to check one's CIBIL score online. Follow one of the methods mentioned above and get access to your credit report for free.

People Also Read: Best Credit Score for Home Loans and How to Improve Yours

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

home+loan Home Loan

[N][T][T][N][T]

Home Loan Refinancing: What, Why, and Things to Remember2024-06-17 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Common Mistakes You Must Avoid Making When Applying for a Loan Against Property2023-02-09 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Pick the Best Home Loan Tenure that Suits Your Budget2023-06-29 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan EMI Calculator Benefits and It’s Features2024-02-21 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Making Financial Planning Easy with a Home Loan EMI Calculator2023-09-06 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Everything You Wanted to Know About Loan Against Property2023-12-16 | 5 Min

tax Tax

[N][T][T][N][T]

Top 5 Tax Benefits and Other Advantages of a Joint Home Loan2024-07-10 | 8 min

[N][T][T][N][T]

6 Smart Tips to Increase Your Home Loan Eligibility2024-06-27 | 4 min

cibil Cibil

[N][T][T][N][T]

High CIBIL Score Helps Low-Interest Rate Loans2024-06-10 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top Benefits of a Loan Against Property Over Collateral-Free Loans2024-01-09 | 4 min

home+loan Home Loan

[N][T][T][N][T]

All About Home Loan Balance Transfers2024-06-04 | 4 mins

home+loan Home Loan

[N][T][T][N][T]

Common Myths About Home Loans: All You Need to Know2024-04-08 | 5 min

[N][T][T][N][T]

Loan Against Property for Doctors: An Essential Checklist2024-05-07 | 2 min

cibil Cibil

[N][T][T][N][T]

Does CIBIL Score Affect Loan Against Property Eligibility?2023-02-15 | 7 min

home+loan Home Loan

[N][T][T][N][T]

How Can NRIs Avail of Home Loans in India2025-03-17 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Step-by-Step Process How to Apply for a Loan Against Property2024-03-05 | 4 Min

home+loan Home Loan

[N][T][T][N][T]

Tips to Get Home Loan with Minimum Down Payment in India2023-07-11 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Understanding EMI: Full Form and Calculation Methods2025-02-24 | 3 min

home+loan Home Loan

[N][T][T][N][T]

A Step-by-Step Guide to Home Loan Balance Transfer Application2024-07-09 | 6 min

tax Tax

[N][T][T][N][T]

Should You Get a Home Loan to Save Your Taxes?2024-02-01 | 3 min

[N][T][T][N][T]

NRI Home Loans: 5 Things to Keep in Mind Before Applying2024-02-15 | 4 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Why is the Interest Component Higher in the Initial EMIs of a Home Loan2025-03-07 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Choose the Right Lender for a Loan Against Property2024-12-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Pre-EMI or Full EMI: Understanding Home Loan Repayment Options2025-01-16 |

loan+against+property Loan Against Property

[N][T][T][N][T]

Things You Need to Know Before Applying for a Loan Against Property2024-12-02 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding All the Charges on Your Loan Against Property2024-12-27 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Short vs. Long Loan Against Property Tenure - Which Is Better?2024-05-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Factors to Consider Before Applying for a Home Construction Loan2022-12-02 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What Is Home Loan Eligibility and How Is It Calculated2024-07-11 | 6 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

[N][T][T][N][T]

Role of Eligibility Calculator Before Availing a Home Loan2025-04-23 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Kerala: A Comprehensive Guide2025-04-11 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Use Loan Against Property EMI Calculator2025-04-23 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Property for Business: What You Should Know2025-04-22 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Can You Convert a Loan Against Property into a Home Loan? Here’s What You Need to Know2025-04-22 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Key Documents to Check for a Safe and Transparent Property Transaction2025-04-22 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Tax Benefits: Is There a Limit on How Many Times You Can Claim?2025-04-22 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

What to Know Before Availing of a Loan Against Property2025-04-22 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

What Happens When You Pay Off Your Mortgage?2025-04-22 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Pay MCD Property Tax in Delhi2025-04-21 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Tax Benefits on Mortgage Loans: What You Need to Know2025-04-21 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Apply for GPRA Accommodation via eSampada and eAwas2025-04-21 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the SVAMITVA Scheme: A New Era of Property Ownership in Rural India2025-04-21 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Property is More Than Just an Asset: 4 Ways It Can Power Your Finances2025-04-21 | 2 min

[N][T][T][N][T]

Home Loan Insurance Benefits for New Home Buyers2025-04-21 | 6 min

home+loan Home Loan

[N][T][T][N][T]

MPIGR Madhya Pradesh: A Guide to Property Registration and SAMPADA Services2025-04-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Consider These Factors Before Foreclosing Your Home Loan2024-04-16 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Top Things to Keep Track of While Doing a Home Loan Balance Transfer2022-12-18 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Smart Things to Consider Before You Apply for a Home Loan2022-12-14 | 5 min

tax Tax

[N][T][T][N][T]

How Much Tax Can be Saved Under Sections 80C, 80D, and 80G?2024-05-15 | 5 min

tax Tax

[N][T][T][N][T]

Tax Benefits on Home Loans for Self-Employed Individuals: What You Need to Know2024-06-07 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Increase Your CIBIL Score Above 800: 7 Proven Methods2023-01-24 | 4 min

home+loan Home Loan

[N][T][T][N][T]

10 Smart Steps for Effective Home Loan Management2024-02-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Should You Take a Home Loan Even If You Have Enough Money to Buy a House?2024-01-30 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Section 80EE: Claim Deductions on the Home Loan Interest Paid2024-04-25 | 6 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

[N][T][T][N][T]

Tips to Manage Loan Against Property Repayments Efficiently2024-02-21 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Differences Between Fixed and Floating Interest Rates2024-05-15 | 2 min

home+loan Home Loan

[N][T][T][N][T]

What Do You Need to Know About Home Loan Foreclosure?2023-03-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Monthly Reducing Balance Method for Home Loan Interest2025-02-25 | 3 min

[N][T][T][N][T]

Everything You Need to Know About Home Loan Part-Prepayment2024-12-18 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Age to Buy a House?2025-03-19 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Complete Guide to Securing a Attractive Interest on Home Loans2024-01-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Check Housing Loan Eligibility with Home Loan Eligibility Calculator2023-07-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Everything You Need to Know About Top-up Loans on a Home Loan2024-04-09 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Get a Home Loan Without Visiting Branch: A Step-by-Step Guide2024-03-20 | 4 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Balance Transfer: Benefits, Eligibility, and More2024-05-15 | 3 Min

[N][T][T][N][T]

7 Benefits of Taking a Home Loan in India2024-06-19 | 3 min

home+loan Home Loan

[N][T][T][N][T]

An Essential Guide to Refinancing a Home Loan2024-04-22 | 5 Min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Tips to Secure Quick Home Loan Approval2025-03-03 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Residential Property: A Smart Financing Solution2025-03-10 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Agricultural Land: Unlock the Value of Your Property2025-03-07 | 6 min

cibil Cibil

[N][T][T][N][T]

Know How Mortgage Loan Affect Your CIBIL Score2024-02-05 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-04-10 | 6 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loans for Salaried Employees: Eligibility, Documents, and Application Process2025-03-18 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Property Mortgage Loan: A Smart Financing Option for Businesses2025-03-10 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Calculate Your Home Loan Eligibility2025-03-05 | 3 min

[N][T][T][N][T]

Loan Against a Shop- Commercial Property Loans2024-12-18 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Home Loan2023-02-20 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

3 Different Loan Against Property Types You Should Know About2024-02-13 | 5 Min

[N][T][T][N][T]

Home Loan for Pensioners: Eligibility and Benefits2025-03-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

5 Great Ways Women Can Benefit from Taking a Housing Loan2024-01-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Self-Employed Individuals2025-03-03 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Professional Loans Against Property Are Financially Beneficial?2023-03-03 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Reasons Why a Housing Loan Application May Be Rejected2024-02-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

6 Reasons Why Collateral Matters When Applying for a Loan Against Property2023-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

Five Reasons Why a Bad Credit Score Could Lead to Loan Rejection2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Top 10 Reasons For Low CIBIL Score & How To Improve It2024-03-01 | 5 min

[N][T][T][N][T]

What is the Purpose of CIBIL Score?2023-03-25 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Joint Home Loan with your Spouse2023-08-04 | 4 min

home+loan Home Loan

[N][T][T][N][T]

What is the Process to Get Your Home Loan Approved Fast with Bajaj Housing Finance?2024-02-15 | 6 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Easy Ways to Pick the Right Loan Against Property Tenor2024-05-14 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Pay-off Your Debt with Bajaj Housing Finance Loan Against Property2024-02-14 | 5 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Report Errors and How to Fix Them_WC2023-07-11 | 4 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons to Maintain a Positive Credit Profile and a High CIBIL Score2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Will a Loan Settlement Ruin My CIBIL Score?2023-03-21 | 4 min

[N][T][T][N][T]

Loan Against Property or A Home Loan: Know What You Need2024-06-11 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Loan Against Property Can be a Good Credit Option for a Startup Business?2023-12-22 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top Benefits of Loan Against Property Over Collateral-free Loans2023-02-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Taking a Home Loan to Buy a Property for Investment? Here Are 5 Points to Consider2023-04-17 | 5 min

home+loan Home Loan

[N][T][T][N][T]

4 Key Benefits of Home Loan Balance Transfer to Bajaj Housing Finance Limited2023-01-09 | 5 min

cibil Cibil

[N][T][T][N][T]

Is a Good CIBIL Score Mandatory for Home Loan Approval?2023-02-17 | 4 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

tax Tax

[N][T][T][N][T]

Income Tax Structure in New Regime: New Tax Exemption Limit 20252024-05-08 | 4 min

tax Tax

[N][T][T][N][T]

8 Useful Income Tax Exemptions for Salaried Employees2024-04-18 | 7 min

home+loan Home Loan

[N][T][T][N][T]

What Affects the Interest Rate on Your Home Loan2024-03-13 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Importance of an NOC Letter after Closing Your Home Loan2023-12-14 | 6 min

home+loan Home Loan

[N][T][T][N][T]

The Importance of a Home Loan NOC2023-01-31 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Importance Of a Good Credit Score in The Home Loan Process2023-03-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

6 Ways to Reduce Your Home Loan Interest2024-03-20 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Apply for a Mortgage Loan?2025-03-05 | 3 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score